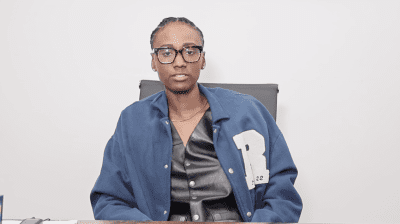

Building a brand for yourself and your company can take some work, and Kendra Bracken-Ferguson has the skills and expertise to help you elevate to the next level. She is the CEO of BrainTrust Founders Studio, the largest membership based platform for Black founders of beauty and wellness companies and a general partner at BrainTrust Fund, a venture fund that invests in Black founders. Bracken-Ferguson has seen what it takes to have a successful business as one of 100 Black women to raise over $1 million in investment for her first company. Now, she’s helping Black beauty and wellness entrepreneurs build and grow their businesses.

Bracken-Ferguson spoke with rolling out about BrainTrust and what things to look for in an investor.

When did you launch your company?

I started my first company, Digital Brand Architects, in 2010, and we were one of the first agencies to manage bloggers. We ended up raising capital, and I became part of the first group of 200 Black women to raise more than a million dollars. I had this vision and notion of being in the boardroom, calling my investors, and having these great conversations, [but] that’s not quite what happened. Through that experience, I learned that it’s one thing to identify an investor, but you have to be careful who your investors are. I wanted to create opportunities to have the investors I wish I had, who were putting in the capital [and with whom] we could talk about business sustainability and generational wealth. By creating the BrainTrust Founders Studio, [now] the largest membership-based platform for Black beauty and wellness founders, we had an opportunity to [look] at capital differently. So, we created the BrainTrust Fund to further support and invest in those Black founders through the studio.

What are some things to take into consideration when looking for an investor?

Not all venture funding is for every company. I always tell founders to look at differentiated sources of funding, from grants to small business loans to pitch competitions, because, in venture, you have to know that we are looking for a return, such as a three- to five-time return, and sometimes greater in other categories. You also have to understand that your investors want information, so send them quarterly reports. We always say good news can wait, but bad news we want first; so [let us know] anything happening with the business [that will] change your revenue or projections. You want to have a relationship with your investors so that you can call them, talk through it, and work on it together. [Look] for investors who have some type of experience in your industry. Do they have experience themselves as operators? Have they invested in other companies? Also, have the investors who have invested in their funds had experience in your industry?