Sometimes, entrepreneurs need a helping hand to build their business or take it to the next level, and Visible Hands is the company that can do just that. Visible Hands believes that investing in women, people of color, and other underrepresented groups is key to creating a prosperous and equitable future for everyone, while also investing in diverse founders who are building venture-backable technology businesses.

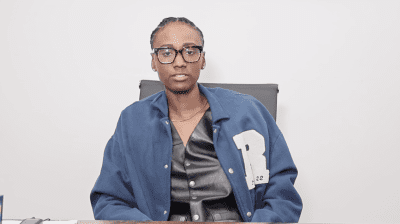

Daniel Acheampong, a general partner and co-founder of Visible Hands, spoke with rolling out about co-founding the company and making the business profitable.

What inspired you to co-found this company?

We all know the numbers that diverse founders receive a small portion of venture backable dollars, and for us, it just doesn’t make sense. My partners and I wanted to build a platform that identifies that talent at the early stages and says, “Hey, how can we support them with capital?” You have to build an infrastructure around them, and with the infrastructure of a strong community, with resources to help them think about the different stages of the company, and also executing to help them move and build a company to the next stages. I always like to highlight that I was born in Ghana. I grew up in the U.S., and I saw my dad as an entrepreneur and how hard he worked. For him, he wanted to find a better opportunity for his kids, and that showed me that entrepreneurship can be a phenomenal way to build, grow, scale, and also do things a little bit differently.

What should people know about making their business profitable?

You have to truly understand how much of your business are you willing to give for an expected dollar of capital. Whatever stage it is, there’s an expectation of a percentage that the investor is probably seeking for a dollar amount that they’re going to give you. This also is related to the valuation of your business. What is the true valuation of your business, ensuring that you have industry comps that you’re looking at the traction of the business, and then just speaking to a lot of people, make sure that you don’t pigeonhole yourself into a deal because it sounds good. You want to make sure that you do your homework, speak with experts, speak with other investors, speak with other entrepreneurs, and leverage those resources to make sure that you’re putting yourself in a good position to either take a deal or bring on a partner.