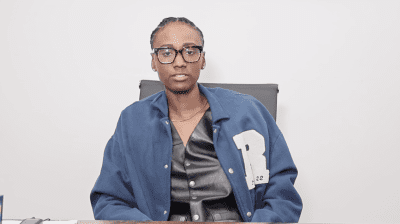

B. Pagels-Minor is leading the way in investing and supporting start-ups and entrepreneurs in the Midwest, South, and Mountain West regions of the United States with the firm, DVRGNT Ventures. Pagels-Minor spoke with rolling out about becoming a funder, and criteria for for participating in the fund.

Why did you become a funder?

I became a funder because it goes back to this idea of how you create a more equal society and a better country, and it’s about economic opportunity. I’m originally from a small town in Mississippi and once a manufacturing company left virtually everyone was out of a job. As I grew up, I realized the reason that happens is that there’s a lack of investment in those communities, so after spending 15 years in tech and doing all of that, I decided to pivot and get to this other economic justice part of the conversation.

The DVRGNT Ventures came out of the ability to take everything I’m learning from tech, and everything I know as a human, and you invest in people who are going to make a change in middle America.

What should a businessperson be ready to present to you for funding?

You have to be prepared to come into the room and tell me who you are. I can’t tell you how often people haven’t done that idea of doing a deep dive and say, “Why am I doing this? Why am I the one who can do this?” Oftentimes, it’s just “I think I should get money because I had this great idea.” The reality is if you don’t have grit, how is it possible that you’re going to be able to withstand all the challenges, all the nos, and all those complexities of being a founder?

The second one is that you have to prove that there’s a real problem. If someone says, “I want to build a company that’s just going to go to the moon,” I’m like, “But why do we have to go to the moon?” Well, because we need resources. You have to have a specific problem that you’re solving that both makes sense and has the potential for financial gain.

The third thing is how you’re actually going to execute. The simple fact is that I invest in precede companies, and that means traditionally they’re much further away from that final large corporation point, but you still should have a pretty good sense of how you will be able to execute. I might say something like, “If I get a million dollars, I’m gonna hire A, B, and C people, and those people provide marketing, and they’re going to help me build my product more effectively.” It’s about having a detailed game plan for how you’re going to execute.