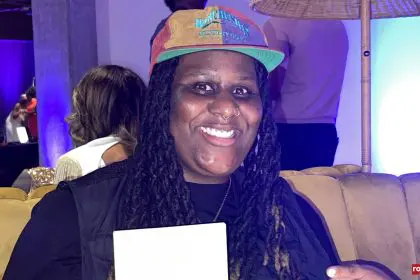

As the Truist Foundation‘s president, Lynette Bell ensures that equitable change for small Black businesses starts with better relationships with banks. In her efforts to invest in communities to build better lives, Bell’s determination and ambition stand out the most when looking at her work over the years.

Bell has held several positions in her 30-plus-year career with SunTrust, now Truist. Now, she is in a role that allows her to ensure the underrepresented have a seat at the table.

On Feb. 29, the Truist Foundation announced a $2 million investment in the Russell Innovation Center for Entrepreneurs (RICE) to foster mentorship, offer essential business resources and support Black entrepreneurs. This investment broadens their access to critical capital and financial literacy opportunities. The day also featured a panel discussion on how Black entrepreneurs can secure access to capital and business resources.

Bell spoke with rolling out about the investment and gave tips to small businesses looking to build capital.

Why was partnering with RICE important for the Truist Foundation?

We knew from the pandemic that many small businesses did not have the resilience to bounce back during an economic disruption like that. So, we realized the complexity of the ecosystem was not just about access to capital but the wraparound of supportive services. Strengthening small businesses and finding an entity like RICE that’s approximate to what’s happening on the ground here in Georgia, but also understanding the complexities of the ecosystem that either supports or derails small businesses was really critical to finding a partner who could help drive and create that resiliency, but also create growth and success.

Why is it good to have friends before you need them?

Relationships are key. You have to build relationships, not only in the community but relationships with partners so that you create the synergy and get the resources or at least access to the resources you need. It’s not just about “I need the cash” at the end, but it’s all that wraparound technical, supportive services that businesses need that help them in the lifecycle of their business, whether it’s a startup phase, or you’re two to three years out. Continue to grow and develop, and all of that has to have supportive wraparound services for that. Finding a partner like RICE or Jay Bailey, who’s very passionate about helping that drive, is really one of the things that Truist is intentional about. Partnerships for us are long and deep.

What do small businesses need to do to gain capital?

I think small businesses need to understand one, what is my business? Understand it like a snapshot, like a report card. What do I do as a business? How do I create it? Who’s my client? Who’s my customer? How do I think about being innovative in a way, but what am I missing in resources? What am I missing in technical support? You can’t know everything if you are specializing in one thing. There are partnerships and relationships that have to be built, whether it’s with a business banker, whether it’s with a nonprofit that’s actually helping micro to small businesses get that capacity and learning. That kind of technical support is critical for growth and development.