ATLANTA and NEW YORK – The Republic of Zambia and Operation HOPE today signed a Memorandum of Understanding to promote financial literacy.

Under the MOU, the two parties will collaborate to promote financial literacy in the Republic of Zambia and with Zambian diaspora in the United States of America, with Zambia joining the Operation HOPE-led ‘Financial Literacy for All’ coalition as its first member state.

Launched by a consortium of leaders from the business, sports, entertainment, and nonprofit sectors, Financial Literacy for All is dedicated to embedding financial literacy in schools, workplaces and communities, so that all people can access quality financial education and achieve greater success in their lifelong financial journey.

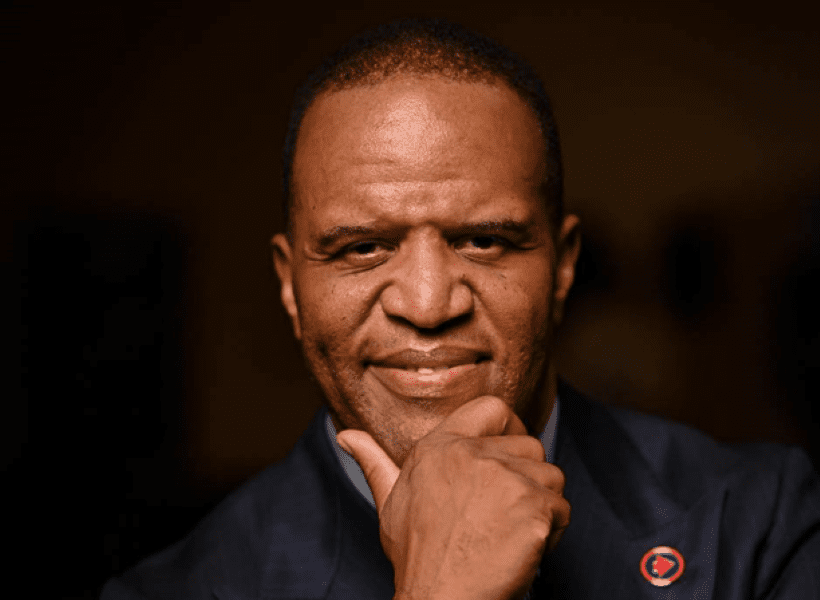

“We are excited to partner with the Republic of Zambia to help its citizens improve financial well-being and fortify their economic empowerment,” said Operation HOPE Founder, Chair, and CEO John Hope Bryant, in a speech read on his behalf by Mr. Eric Kaplan, who signed the MOU in his capacity as Executive Vice President of Operation HOPE and President of Financial Literacy for All. “This MOU – which welcomes the Republic of Zambia as the first country to join our Financial Literacy for All initiative – is a major step forward in our mission to ensure that everyone has the knowledge and skills they need to make informed financial decisions and build a strong foundation for economic security and wealth generation.”

The signing ceremony was witnessed by Hon. Doreen Mwamba, M.P, Minister of Community Development and Social Services.

In her remarks, Hon. Mwamba said financial literacy training will enable Zambian youths to make informed decisions for their businesses. Ministry of Information and Media Permanent Secretary, Mr. Thabo Kawana and Bank of Zambia Deputy Governor, Ms. Rekha Chifuwe Mhango also attended the ceremony.

With their commitment, the Republic of Zambia will explore the development of a wide range of financial literacy initiatives, including:

- Developing and delivering financial literacy workshops and courses;

- Creating and distributing financial literacy materials;

- Partnering with schools and community organizations to promote financial literacy; and

- Economic empowerment of Zambian citizens, including Small and Medium Enterprises (SMEs).

“The Government of Zambia is committed to ensuring that all of our people have access to financial education,” said His Excellency Dr. Ambassador Chola Milambo, United Nations Representative of the Republic of Zambia. “This MOU is a significant milestone in our efforts to achieve this goal.”

About the Republic of Zambia

The Government of the Republic of Zambia through the Ministry of Finance and National Planning is implementing the National Financial Inclusion Strategy (NFIS) which is anchored on the National Sector Development Policy (NFSDP) to accelerate financial inclusion in Zambia which will lead to the development of a competitive and resilient inclusive financial sector.

The Policy and Strategy were launched in 2017 and align with supporting the National Development Plan and the Vision 2030 of “Making Zambia a prosperous middle-income nation by 2030”. This is in the spirit of not leaving anyone behind in the national development agenda.

In addition, as part of its National Financial Sector Development Policy, the government is implementing the Second National Strategy on Financial Education (NSFE II, 2019-2024) as a successor to the first National Strategy on Financial Education which run from 2012 to 2017.

The strategy sets out a comprehensive framework for strengthening financial education in Zambia. The primary objective is to empower Zambians with knowledge, understanding, skills, motivation and confidence to help them to secure positive financial outcomes for themselves and their families.

Since its launch, several financial education initiatives have been implemented, resulting in the overall improvement in financial literacy levels in Zambia. However, more needs to be done to realize the strategic vision of having a financially educated Zambian population by 2030.

Furthermore, the Government has renewed its commitment to continue improving financial inclusion in Zambia with its decision to develop the second National Financial Inclusion Strategy (NFIS 2024-2028).

About Operation HOPE, Inc.:

Since 1992, Operation HOPE has been moving America from civil rights to “Silver Rights” with the mission of making free enterprise and capitalism work for the underserved—disrupting poverty for millions of low and moderate-income youth and adults across the nation. Through its award-winning community uplift model, HOPE Inside, which received the Innovator of the Year recognition by American Banker magazine, Operation HOPE has served more than 4 million individuals and directed more than $4 billion in economic activity into disenfranchised communities—turning check-cashing customers into banking customers, renters into homeowners, small business dreamers into small business owners, minimum wage workers into living wage consumers, and uncertain disaster victims into financially empowered disaster survivors. Operation HOPE recently received Fast Company’s World Changing Ideas Award for driving entrepreneurship as well as its tenth consecutive 4-star charity rating for fiscal management and commitment to transparency and accountability from the prestigious non-profit evaluator, Charity Navigator. Operation HOPE also recently launched The 1865 Project, an initiative designed to help level the economic playing field for underserved Americans.

For more information: OperationHOPE.org. Join the HOPE conversation on Twitter, Facebook, Instagram and LinkedIn.