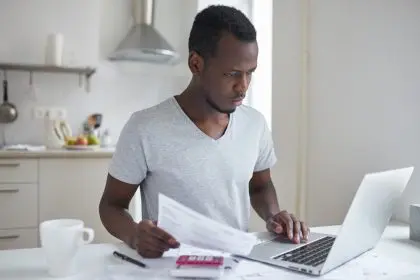

Credit cards can be a convenient way to manage finances, but they can also quickly spiral out of control if not handled responsibly. Understanding the warning signs that your credit cards may be causing more harm than good is essential to maintaining financial health. This article will explore six key indicators that your credit cards are out of control and provide insights on how to regain control before it’s too late.

Struggling to make minimum payments

One of the first signs that your credit cards are out of control is when making the minimum payment becomes a challenge. If you find yourself barely scraping together enough money each month to meet the minimum payment, it’s a red flag. This situation indicates that your credit card debt is accumulating faster than you can pay it off, leading to a vicious cycle of increasing interest and financial stress.

When you’re only making the minimum payment, you’re primarily covering interest charges, with very little going toward the principal balance. This prolongs the debt and can make it feel like you’re making no progress, which can be emotionally draining and financially crippling over time.

Maxing out credit limits

Another clear sign that your credit cards are out of control is if you consistently reach or exceed your credit limit. Maxing out your credit cards not only damages your credit score but also indicates that you might be relying too heavily on credit to meet your daily expenses. When your credit cards are maxed out, it becomes nearly impossible to use them in emergencies, leaving you financially vulnerable.

Maxing out your credit limits also leads to higher interest rates and fees, which can further exacerbate your debt situation. It’s essential to monitor your credit utilization ratio — the amount of credit you’re using compared to your total available credit — to ensure it stays within a healthy range, typically below 30 percent.

Ignoring your credit card statements

If you’ve started avoiding your credit card statements, it’s a major warning sign. Ignoring your statements may be a coping mechanism to avoid confronting the reality of your financial situation. However, this avoidance can lead to missed payments, higher interest rates and mounting fees, all of which contribute to the snowball effect of debt.

Ignoring your credit card statements also means you might miss noticing unauthorized transactions, errors or changes in terms and conditions that could further impact your finances. Facing your statements head-on — even if they’re overwhelming — is crucial to regaining control over your credit.

Using credit cards for everyday expenses

Using credit cards for everyday expenses like groceries, gas and utilities can be a sign that your finances are stretched thin. While using a credit card for convenience is fine if you pay off the balance each month, relying on credit for day-to-day expenses often indicates that your income isn’t sufficient to cover your living costs.

This habit can quickly lead to an unmanageable level of debt, especially if you’re not able to pay off the balance in full each month. It’s important to create a budget that allows you to live within your means without depending on credit cards for essentials.

Juggling multiple credit cards

If you’re juggling multiple credit cards to manage your finances, it’s a sign that things may be out of control. Balancing several credit cards often leads to confusion, missed payments and higher interest rates. Additionally, the temptation to open new cards to transfer balances or take advantage of promotional offers can lead to even more debt.

Juggling multiple credit cards can also be a psychological burden, leading to stress and anxiety as you try to keep track of due dates, balances and payment amounts. Consolidating your debt or focusing on paying off one card at a time can help you regain control and reduce the mental load.

Experiencing financial stress and anxiety

The emotional toll of credit card debt is a significant sign that things are out of control. If your credit card debt is causing you to lose sleep, feel anxious or experience constant worry about your financial future, it’s time to take action. Financial stress can impact every aspect of your life, from your relationships to your job performance, and can even lead to physical health problems.

Recognizing the emotional impact of your credit card debt is crucial in understanding that it’s not just a financial issue but a quality-of-life issue as well. Taking steps to address your debt and seek support if needed can help alleviate this stress and set you on a path to financial freedom.

Navigating overwhelming debt

Credit card debt can quickly become overwhelming if not managed carefully. Recognizing the signs that your credit cards are out of control is the first step toward regaining financial stability. Whether you’re struggling to make minimum payments, maxing out your limits, ignoring statements, using credit for everyday expenses, juggling multiple cards or experiencing financial stress, it’s important to take action.

Regaining control over your credit cards involves creating a realistic budget, prioritizing debt repayment and possibly seeking professional advice. By addressing the issue head-on, you can break free from the cycle of debt and build a healthier financial future.

Taking control of your credit cards can also lead to better mental and emotional well-being, as financial security is closely linked to overall life satisfaction. Remember, the key to successful credit management is awareness and proactive action. Don’t let your credit cards control you — take the necessary steps today to regain control and enjoy a brighter financial future.

This story was created using AI technology.