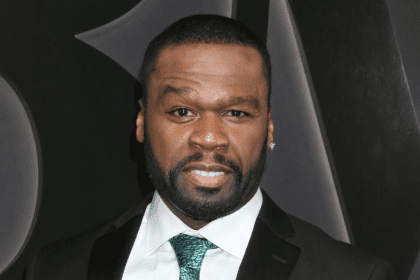

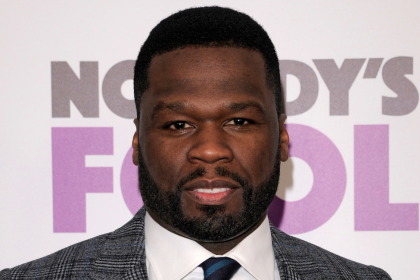

Music mogul Curtis “50 Cent” Jackson celebrated a pivotal victory as Louisiana’s Senate Committee voted to preserve film and television tax incentives, despite an earlier House vote to eliminate the program. The decision ensures the incentives continue through 2025, though with a reduced cap from $150 million to $125 million.

The debate intensified following Republican Governor Jeff Landry’s 2023 campaign promise of tax code reforms. Industry data shows the state’s film sector generates roughly $900 million in annual economic activity, supporting thousands of jobs across Louisiana.

Jackson’s G-Unit Films has established a Shreveport headquarters, with investments potentially exceeding $100 million. The facility includes production spaces, post-production suites and training centers. The company’s presence has already boosted local economy through events like the Humor & Harmony Weekend Festival, which generated over $2 million in its first year.

The preserved tax credit program maintains its core offering of up to 40 percent credit on qualifying expenditures, plus an additional five percent for projects filmed outside New Orleans. Industry experts project potential growth reaching $1.2 billion in annual economic impact by 2025.

Development continues across the state, with a $50 million production complex in Baton Rouge and a $35 million digital media center in Lafayette underway. These projects should create about 2,500 construction jobs and 1,800 permanent positions. Local universities partner with facilities to develop specialized training programs.

Studies indicate each tax credit dollar generates $3.30 in local economic activity. The hospitality sector reports $150 million in annual hotel revenue, while transportation services gain $75 million. Food service benefits from $120 million in restaurant expenditures, and technical services generate $200 million in equipment rentals and professional services.

Louisiana maintains competitive positioning among southeastern states offering film incentives. While Georgia leads with a 30 percent base credit, Louisiana’s additional incentives for rural production and infrastructure development provide unique advantages, attracting over 100 projects annually.

The state’s commitment to entertainment industry growth extends beyond tax incentives. A comprehensive workforce development initiative allocates $15 million toward film industry skills training. Community colleges offer technical programs alongside advanced degree opportunities in film production, creating pathways for local talent to enter the industry.

The decision to preserve tax credits came after intense lobbying from industry stakeholders, including Jackson, who emphasized the program’s economic multiplier effect. Local businesses, from catering services to equipment rental companies, voiced strong support for maintaining the incentives, citing substantial revenue increases tied to production activity.

Industry observers note Louisiana’s strategic position in the entertainment sector, with its diverse filming locations ranging from historic New Orleans architecture to rural bayous. The state’s experienced crew base, developed over two decades of consistent production activity, provides additional appeal to major studios and independent producers alike.

Jackson’s investment in Shreveport symbolizes a broader trend of entertainment industry decentralization, as production companies seek alternatives to traditional hubs like Los Angeles and Atlanta. The G-Unit facility’s focus on technological innovation and workforce development aligns with Louisiana’s vision for sustainable industry growth.

The preservation of film incentives signals Louisiana’s long-term commitment to creative sector development, potentially attracting additional investment from major studios and production companies. Industry leaders project this could lead to expanded infrastructure development and increased production activity across the state.