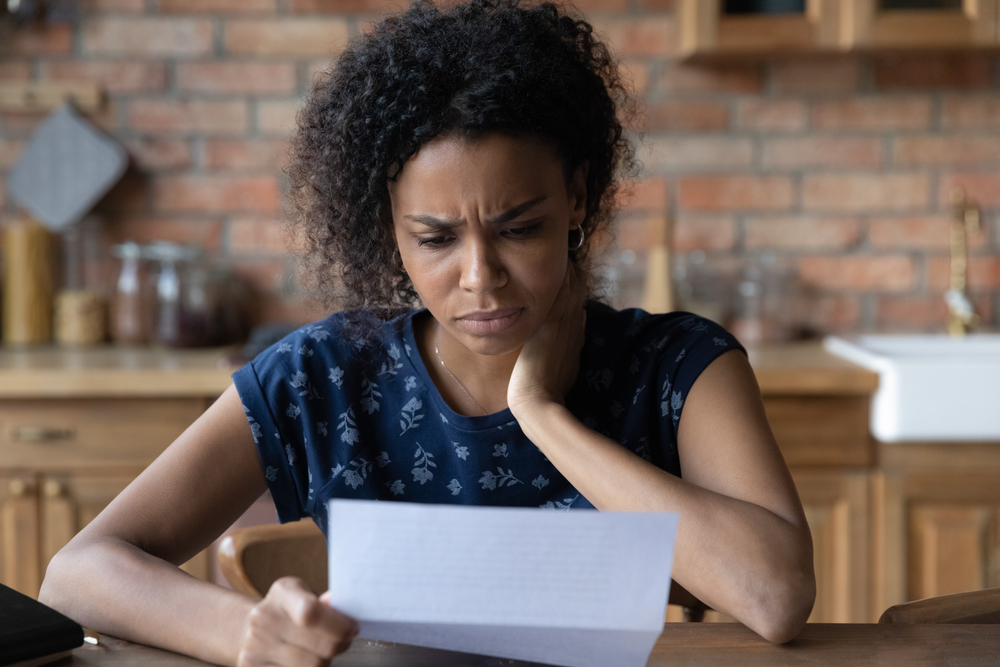

In today’s digital age, automatic bill payments promise convenience and peace of mind. However, financial experts warn that some bills require manual oversight to protect your wallet and prevent costly mistakes. Understanding which payments to keep under close watch can save you from unexpected financial headaches.

Utility bills demand attention

While setting up autopay for utilities might seem logical, energy and water bills pose unique risks when automated. Usage fluctuates seasonally, and unexpected spikes can wreak havoc on carefully planned budgets. A summer heat wave or hidden pipe leak could send bills soaring without warning.

Financial advisors report that automated utility payments often lead to overlooked billing errors. Manual review allows homeowners to spot unusual patterns, contest incorrect charges, and adjust consumption habits based on costs. Many utility companies now offer usage alerts and estimated bill notifications, making manual payments more manageable.

Credit card payments require vigilance

Credit card automation presents perhaps the greatest risk to financial health. While automatic minimum payments might prevent late fees, they often mask deeper financial issues and can perpetuate debt cycles.

Regular review of credit card statements serves multiple purposes:

- Catches fraudulent charges early

- Prompts conscious spending decisions

- Allows for strategic payment timing

- Prevents overlooked billing errors

Consumer protection advocates recommend setting payment reminders instead of automating. This approach maintains awareness while preventing missed due dates.

Subscription services drain silently

The subscription economy has transformed how we consume services, from entertainment to meal delivery. However, automated payments for these services often lead to forgotten memberships and unnecessary expenses.

Recent studies show the average household wastes hundreds of dollars annually on unused subscriptions. Companies frequently adjust pricing or change service tiers, counting on consumers’ inattention to maintain revenue.

Manual payment forces regular evaluation of service value. Consumers who actively manage subscriptions report better budget control and fewer unwanted services.

Medical bills require scrutiny

Health care billing presents unique challenges that make automation particularly risky. Medical billing experts estimate that up to 80% of hospital bills contain errors, making careful review essential.

Insurance coverage changes, billing codes, and provider adjustments can significantly impact final costs. Automated payments might process before:

- Insurance claims are fully processed

- Billing errors are identified

- Payment assistance options are explored

- Negotiation opportunities arise

Health care consumer advocates recommend thorough review of all medical charges against insurance explanations of benefits before payment.

Gym memberships hide complications

Fitness industry practices make gym memberships particularly problematic for automation. Contract terms often include complex cancellation procedures and automatic renewal clauses designed to maintain revenue.

Consumer protection agencies report frequent complaints about:

- Unexpected rate increases

- Difficult cancellation processes

- Hidden fees and charges

- Extended billing after cancellation requests

Fitness industry experts recommend month-to-month payments to maintain control over membership status and costs.

Maintaining financial control

While automation works well for fixed expenses like mortgage payments or car loans, variable bills require active management. Financial planners recommend creating a monthly bill review routine that includes:

Schedule specific days for bill review and payment. This creates structure without sacrificing oversight.

Maintain detailed records of payment amounts and patterns. This helps identify trends and anomalies quickly.

Set calendar reminders for due dates rather than relying on automatic withdrawals. This preserves control while preventing late payments.

Smart money management

Taking control of these five payment categories often reveals opportunities for savings and prevents financial surprises. While the digital age promotes automation as a solution for everything, some financial decisions deserve personal attention.

Consider using banking alerts and budget tracking apps to stay informed without surrendering control to automatic payments. This balanced approach maintains convenience while protecting your financial interests.

Remember that financial health requires active participation. The time invested in managing these crucial payments often pays dividends through avoided fees, caught errors, and optimized spending.

This story was created using AI technology.