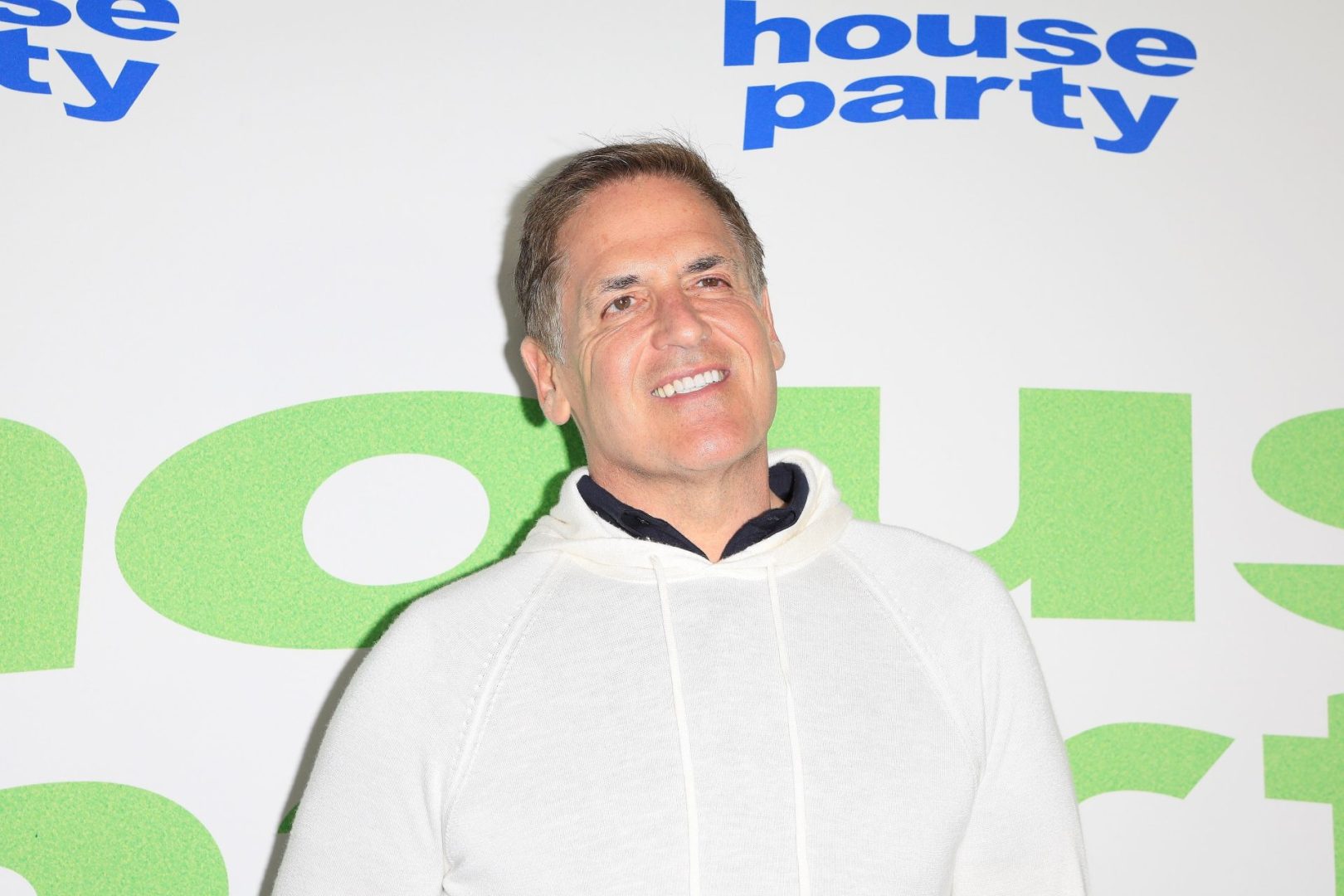

Mark Cuban, the billionaire investor and a minority owner of the Dallas Mavericks, recently shared his insights on Black women entrepreneurs during a panel discussion at the 2025 South by Southwest (SXSW) festival in Austin, Texas. Cuban advised Black women founders to reconsider their approach to funding, suggesting they should stop looking for funding altogether. Instead, he emphasized the importance of utilizing sweat equity to build their businesses from the ground up.

In the world of entrepreneurship, Black women face unique challenges, particularly when it comes to securing funding for their businesses. Recent statistics reveal that Black women who apply for funding are three times more likely to be rejected compared to their White counterparts. This alarming disparity highlights the urgent need for alternative strategies to empower Black women entrepreneurs.

The importance of sweat equity

Cuban’s advice centers on the idea that entrepreneurs should focus on developing their businesses organically, even if it means starting smaller and progressing at a slower pace. He explained that this approach allows founders to learn about their business and make it loan-worthy while also understanding the financial language necessary for securing loans. Cuban stated, “You have to figure out a way to use sweat equity to build it on your own.” This perspective encourages Black women entrepreneurs to harness their skills and knowledge rather than relying solely on external funding.

The funding gap for Black women entrepreneurs

The funding gap for Black women entrepreneurs is a pressing issue. According to data from Stearnsbank, Black women face significant barriers when seeking financial support. The statistics show that they are three times more likely to be denied funding compared to other demographics, including white business owners. This systemic inequality is further compounded by the experiences of successful entrepreneurs like Carmen Tapio, founder of North End Teleservices, who faced discrimination despite having an excellent credit score and business reputation.

Discrimination in lending

Tapio’s story illustrates the challenges that many Black women entrepreneurs encounter. Despite her 850 credit score, she struggled to secure a Paycheck Protection Program loan, highlighting how historical decisions can impact access to funding for entrepreneurs of color. Tapio noted, “Decisions that were made decades ago in some instances … can put real constraints on the ability of entrepreneurs of particular races from participating in the systems and the programs that are out there.” This sentiment resonates with many Black women who find themselves navigating a biased financial landscape.

The venture capital landscape

Moreover, the venture capital landscape presents additional hurdles. Only 2 percent of venture capital funding is allocated to female-only founding teams, which disproportionately affects women of color. Arian Simone, CEO of the Fearless Fund, has been vocal about these disparities. Her firm focuses on investing in under-resourced entrepreneurs, particularly women of color. However, initiatives like the Fearless Strivers Grant contest, which aimed to support small businesses led by women of color, faced legal challenges that hindered their efforts.

Financial literacy and predatory lending

Cuban acknowledges the difficulties Black women entrepreneurs face in securing funding and emphasizes the importance of financial literacy. He warns against predatory lending practices that target individuals lacking financial knowledge. Cuban stated, “There’s a lot of predatory lending out there, and it’s awful. [The lenders] see people who may not have the financial literacy or understanding, and they’ll say, ‘Oh, yeah, I’ll make you a loan.’” This highlights the need for Black women to educate themselves about financial options to avoid exploitation.