The entertainment industry received a seismic shock this week with President Donald Trump’s announcement of potential 100% tariffs on films produced outside American borders. Trump framed the move as necessary protection for the domestic film industry and even suggested foreign film production represents a national security concern.

This dramatic policy shift sent immediate ripples through financial markets and sparked widespread confusion about implementation details. Industry insiders and international partners are scrambling to understand the ramifications of a tariff system that could fundamentally alter how movies are made and distributed globally.

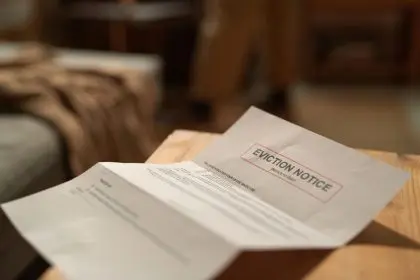

The evaporating Hollywood dream

For decades, film production has been steadily leaving the traditional hub of Southern California. What was once the undisputed center of global filmmaking has watched as productions increasingly choose international locations offering financial incentives and lower costs.

This migration has left its mark on the physical landscape of Hollywood itself. Once-bustling studio lots and production facilities have seen decreased activity as filmmakers chase tax credits and incentives in places like the United Kingdom, Canada, Australia, and New Zealand.

President Trump points to this exodus as evidence that foreign countries are deliberately luring away American cultural production through what he characterizes as unfair financial incentives. Trump claims this trend represents not just an economic challenge but a strategic threat to American cultural influence.

The complicated economics of modern filmmaking

The reality of modern film production rarely fits into neat national categories. Major blockbusters routinely film across multiple countries, sometimes for financial reasons but often because storylines demand authentic international locations.

Recent examples illustrate this complexity. This year’s top-grossing film was shot in New Zealand, while another major superhero release filmed scenes across multiple continents including North America, Asia, and the Middle East. These productions often employ thousands of American workers alongside international crew members.

The global nature of modern filmmaking raises fundamental questions about how tariffs could be calculated or enforced. Would a film shot 60% in America and 40% abroad face a proportional tariff? Would productions that film overseas for authentic location needs face the same penalties as those chasing tax incentives?

Industry analysts note that even defining what constitutes an “American” film presents significant challenges. Is nationality determined by financing source, production location, citizenship of key creative personnel, or some combination of factors?

Stock market turbulence reflects industry panic

Financial markets reacted swiftly to the tariff announcement. Major entertainment stocks experienced significant declines, with streaming platforms taking particularly hard hits.

One major streaming service saw its shares drop nearly 4% in early trading, representing a market capitalization loss of over $20 billion in a single day. Other entertainment conglomerates faced similar downward pressure, with losses ranging from 1% to 3% across the sector.

The disproportionate impact on streaming services highlights their particular vulnerability to such policy shifts. These platforms have built global production networks that allow them to create content specifically tailored to regional audiences worldwide. Their business models rely heavily on the ability to produce content internationally without significant trade barriers.

International reaction mixes concern with defiance

Countries that have built substantial film industries partially through attracting international productions expressed immediate concern about the proposed tariffs.

From the United Kingdom to Australia to New Zealand, government officials and industry representatives issued statements defending their film sectors. Several emphasized the highly skilled workforces they have developed and suggested that financial incentives are only part of what attracts productions to their shores.

One government official from the Pacific region made clear that they would “stand up unequivocally for the rights” of their national screen industry. Another nation’s leader promised to be a “great advocate, great champion” for their film sector in response to the tariff proposal.

These responses suggest potential for international trade tensions beyond just the entertainment sector if tariffs are implemented. Some analysts worry that affected countries might respond with counter-measures targeting American films or other cultural exports.

The tangle of implementation questions

Beyond the broad political and economic implications, entertainment industry insiders are grappling with practical questions about how such tariffs might function in reality.

Unlike traditional imported goods that arrive at ports with clear country-of-origin documentation, films represent complex intellectual property with multinational production histories. Determining the nationality of a film for tariff purposes presents unprecedented challenges.

Would streaming services face different rules than theatrical releases? How would co-productions between American and international companies be treated? Would visual effects work completed overseas incur tariffs even if primary filming occurred domestically?

A European cinema chain executive highlighted this complexity, questioning how officials would define a “US film” when considering where funding originated, where filming occurred, and the nationality of cast, crew, and creative leadership.

California caught in the crossfire

The Trump administration’s move also sparked a domestic political dimension, with President Trump directing criticism at the leadership of California for allegedly allowing the film industry to erode under their watch.

Trump suggested the state government bears significant responsibility for creating conditions that drove productions elsewhere. This framing positions the tariff proposal as addressing both international competition and domestic policy failures.

California representatives rejected this characterization, with the state government questioning the legal authority for imposing such tariffs. They cited the International Economic Emergency Powers Act, arguing that tariffs are not listed as an authorized remedy under that legislation.

What happens next remains uncertain

The timeline and practical implementation of the proposed tariffs remain unclear. President Trump has directed officials to begin the process, but few specifics about how or when such measures might take effect have been provided.

Industry observers note that the process of designing and implementing such an unprecedented tariff system would likely face significant legal and practical hurdles. The unique nature of film as both cultural expression and commercial product creates regulatory complexities unlike traditional imported goods.

Some financial analysts have suggested the uncertainty itself could impact industry decision-making even before any actual tariffs are imposed. Studios planning future productions may delay commitments to international filming locations while awaiting policy clarity.

The broader trade landscape grows more complex

This latest development comes amid a series of escalating trade disputes between the United States and multiple international partners. Earlier tariff announcements by President Trump targeting various sectors had already created economic uncertainty in global markets.

The film industry tariff proposal represents an expansion of Trump’s trade restrictions into the cultural and intellectual property realm, potentially opening new fronts in ongoing economic tensions. Entertainment industry veterans note that this shift could have unpredictable consequences for American cultural exports as well as imports.

Some countries have already taken retaliatory measures in the cultural sector. Earlier this year, Chinese officials reduced their quota for American films allowed into their market, explicitly citing U.S. tariff policies as justification.

The battle for Hollywood’s future

As this situation unfolds, the fundamental question of Hollywood’s future remains unresolved. Can policy measures reverse decades of production migration, or will they simply add new complications to an already challenging industry?

Industry veterans point out that the exodus from Southern California began long before recent policy shifts and stems from complex economic factors beyond just international competition. High costs of living, traffic congestion, and regulatory environments all contribute to production decisions.

Meanwhile, other regions have invested heavily in building competitive advantages beyond just financial incentives. The United Kingdom has developed world-class production facilities and highly skilled technical workforces that attract filmmakers regardless of tax considerations.

As summer blockbuster season approaches with its lineup of internationally-produced spectacles, audiences remain largely unaware of the behind-the-scenes trade disputes that could transform how their favorite entertainment is created. Whether these proposed measures will ultimately reshape Hollywood or simply add new complications to an already complex global industry remains to be seen.