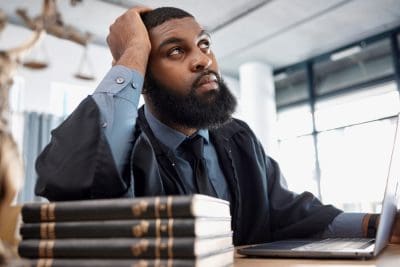

Debt is something many people face on a regular basis, but how a person deals with debt is important. Stress related illness such as anxiety and depression seem to go hand-in-hand and will make a bad problem worse and can have an impact on a person’s physical and mental health. Anxiety caused by heavy debt, job insecurity and daily routine have become common for the indebted individual. The question then becomes what can be done to alleviate this pressure?

Debt counselor Malcolm Hurlston has a possible solution that entails a change in lifestyle, such as exercise, and letting a financial institution become aware of what challenges you are facing. Hurlston is the founder of Consumer Credit Counseling Services now called StepChange and his take on the situation can bring relief to those struggling with this issue. Hurlston states, “Sometimes, health problems are brought on by debt; sometimes, it is the other way round. Mostly it is a vicious circle. The link between debt and health, both physical and mental, is now widely recognized and lenders are geared up to take it into account. It is more common sense than rocket science but formal recognition took longer than you might have expected…”

Per Hurlston, the first step that a person must take is to recognize her/his limitations and the level of debt and payment obligations one faces. “People who are anxious and risk averse should ensure they know how the debt can be repaid before they commit. With mortgages, of course, a different order of prudence is needed,” states Hurlston.

Awareness must be combined with sharing your financial situation with the lenders involved and Hurlston’s organization, StepChange, hopes to be a part of that process by addressing stress management and anxiety at the same time. StepChange offers a service that will measure the level of anxiety and will offer free cognitive behavioral therapy online for those who qualify. Hurlston states, “The progression is seamless – people don’t need to re-enter any details – so the twin problems can be tackled together.”

Hurlston has given three tips on how you can minimize stress brought on by debt:

Take action as soon as possible: prevent the problem from snowballing into a much bigger one. Do not ignore bills. Taking small steps and devising a plan will help restore confidence and keep the problem in perspective.

Do not isolate yourself: access help from free counseling services which will offer advice in debt management, devising repayment plans and dealing with associated health problems. Talk to your doctor, a friend or another trusted person; stay active: take up a new form of exercise and explore free fitness options whether it is walking in the park, cycling or home exercise.

Practice mindfulness: projecting fear into the future will only increase stress levels. Stay positive and surround yourself with positive people, learn to live in the moment and take each day at a time.

To find out more, visit StepChange.