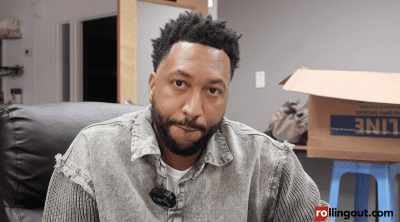

With over 20 years of experience working with industry leaders like Nationwide Insurance, AT&T, Emerson and Wells Fargo, Lu Yarbrough has a comprehensive marketing, relationship management, advertising, communications and sales management background. He sat down with rolling out to share advice for aspiring entrepreneurs, Black Enterprise and more.

Nationwide has had a long-standing partnership with Black Enterprise. Tell us what this partnership and the Entrepreneurs Summit mean to Nationwide.

It started 90 years ago in 1926, with a small group of individuals and entrepreneurs, $10,000, and an entrepreneurial idea of providing affordable auto-insurance for rural farmers. Coming from that humble beginning and then realizing what a lot of the attendees are realizing and recognizing here at the event like the Black Enterprise Entrepreneurs Summit, [that] at the end of the day, we already have the tools to fashion our own destiny.

When you come from that type of heritage and beginning, and then you look at Nationwide today. We’re a Fortune 100 company, we have over 33,000 associates. You want to give back, help and encourage other entrepreneurs to do the same. The relationship with Black Enterprise is all about doing that. It’s all about access, information and giving black entrepreneurs the opportunities to connect with each other as well as other organizations who are going to help them along that way. Not many organizations have a passion of helping entrepreneurs make it to the next level. When you come from that heritage and you understand what it takes to get there and that it can be done, you want to be a part of that. Our relationship with Black Enterprise allows us to stay connected with small business and entrepreneurs.

What are some key products that Nationwide offers to entrepreneurs?

It’s funny that you say that. Most folks know that Nationwide [offers] auto and home insurance but very few people realize that we’re actually the No. 1 small-business insurance. … We also have a strong portfolio of financial services that allow entrepreneurs and their employees to plan and live for retirement. So it’s really a breadth of products to help them from the early stages to the end of retirement.You can pass it on to others through life insurance.

So what you’re saying is, Insurance for entrepreneurs is more than just about protecting assets?

Absolutely. Insurance for entrepreneurs is about protecting lifestyle and legacy. Most people don’t look at it that way but that’s really what it’s about. It’s about making sure that whatever is most important to you, is preserved. That’s the way we approach it, by trying to build an enduring relationship, one small business at a time, one personal policy at a time. Because of that, we call our customers, members. Because we are a mutual company. Our shareholders are the people doing business with us. We want them to have a member experience, not just a transactional one.

What do you find are some of the biggest obstacles that entrepreneurs face in their first few years in business?

Going back to why Black Enterprise’s relationship is so important to us; I get to hear firsthand what those obstacles are. Lot’s of time you will hear the common ones “lack of funding,” “lack of access to funding” and “lack of scalability.”

Fundamentally, when I listen to them, their biggest challenge is clarity about what problem they are tying to solve. A lot of small businesses spend their time trying to solve the wrong problem. I’ve heard a number of them say; “Hey! I’ve got a product that people need.” But if the customer’s not saying “I want that product” or “I’m willing to pay for that product,” you’re not going to be able to solve that problem for them.

The biggest challenge I see is them being able to have “clarity” on what business problem they are trying to solve and identifying who their customer because you can’t be all things to all people. Sometimes when you do that it doesn’t mean you exclude a group of folks as your customers, you just make sure that you understand that for what you’re offering as a small business, these members are most likely intrigued by it and want to build a relationship with me.

Should entrepreneurs seek different products depending on their net worth?

They should seek different products based off their “network” of people around them. A lot of entrepreneurs underestimate the network of people that they already have around them that they are underutilizing and not leveraging.

What things should entrepreneurs already have in place before they reach out to you?

There [are] a couple of things. One, they have to be crystal clear on what it is that they want to accomplish as a business. Do they want to create a kind of company that’s about lifestyle or legacy? Because you’ll make different choices. If you basically want to start a business to create enough income for you to obtain and sustain a certain lifestyle, you’ll make difference choices than the individual that says “Hey, I may sacrifice a few things on the lifestyle part, because I really want to build a legacy of a business that I can give over to an heir after I’m gone.” That’s something you have to be clear with up front — lifestyle or legacy. Then it is crystal clear on what you’re providing.

Sometimes when you have a great idea and you’re passionate about it, folks get confused or distracted about what is it their core competency is on, [and] what they can provide better and different from the competition that’s already out there. That aligned with [answering the question], who is at the end of the day, your end consumer? The person who has the demand and is willing to pay for what it is that your offering. If you have those thing in place then we can start talking about the next steps from a business planning standpoint. Nationwide has a supplier diversity program that people can apply to for free, whether they are at that stage of doing business with Nationwide or not. Nationwide will mentor them to get to the point of where they are a viable business to have a relationship with a Nationwide or some other Fortune 100 company.

What would you say is the minimum amount of protection a business owner should have?

I think that varies. That varies on the amount of money the individual has already spent on hard fixed assets. if you have a building that you own, the amount you need is going to be related to the value of that building versus if you don’t have that building and you’re working out of your home or apartment. What I would recommend is talking to a professional in commercial insurance to talk about the assets you have, and how to protect those without depleting the revenue needed to actually do business on a day-to-day [basis].