Many of us are told by our parents and society that homeownership is the best path to lasting wealth. There’s no question that it’s one of the smartest ways to build generational wealth. But just like all financial decisions, the choice to buy a home should be made within the context of your overall life goals. However, the dream of owning a home is one that comes with a lot of planning and education — it is a dream that shouldn’t be rushed to achieve.

Having free resources such as yourFirst MortgageSM can help educate future homeowners on what to expect.

According to the 2012 Census less than 50 percent (42.5 percent) of African Americans are active homeowners. Reasons for this vary — miseducation of the process of how to attain homeownership, hesitation of breaking free of renting. Despite these “fears” of entering the buying market, many African Americans are still interested in buying a home. It is essential that they arm themselves with the right tools and resources to ensure they can make informed decisions in order to achieve sustainable homeownership.

For example, many believe that you must make a 20 percent down payment when, in fact, that is not true. There are many perks first-time homebuyers can take advantage of.

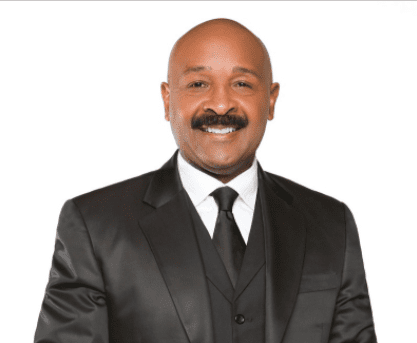

Here, rolling out speaks with Rob Robertson, area sales manager, Wells Fargo Home Mortgage, who is based in Sarasota, Florida. He offers tips for buyers embarking on the homeownership journey and insight on their recently announced, yourFirst MortgageSMprogram. –carles summerour

Can you tell us a little bit about your day-to-day routine at work?

Honestly, it’s just being out in the community, helping our customers succeed financially. Also, engaging with our team members, navigating options for our customers day-to-day, engaging with realtors and our builders. Seeing some of the businesses in working progress going down Interstate 75, gives me a great pleasure because that means more opportunities.

What are your responsibilities?

In southwest Florida, I cover the areas from Bradenton … I-75 straight down is my north tip, down through Sarasota, to Fort Myers, and down to Naples. I have Collier County, Lee County, Manatee County, and Sarasota County.

Exactly how long have you been on this side of the business?

For this side of the business, it’s been 15 plus years.

Over the past three to five years, what are some of the changes you’ve faced?

The market in general has changed. A lot of compliance changes for lenders have been things that we have had to adapt to. For an example, we have Dodd Frank and TRID, and different laws that are associated with our business which we all had to adapt to as an industry. The good news in that is, the market has stayed consistent in productivity in a sense where rates have and still are at historical lows, in addition to affordability. Over the years, I’ve seen a lot of homeowners or first-time homeowners get approved. In the past, higher rates caused homeownership to be a little challenging. Because of the rates being historically low, customers are able to get into homes with a relatively good rate, which results in a good payment that’s affordable for consumers.

What’s considered a good rate?

It depends on who you ask. I would say a good rate, due to the current market, it’s in the low to mid 3’s in some situations. When I got into business, if you had a 9 or 10 percent rate, people were happy. When looking at interest rates that have fallen to historic lows in mid-3 or 4 percent, those are exceptional interest rates for consumers in terms of buying homes

What are some things you would suggest to a young college graduate, whose fresh to the working world, and looking to buy a home?

I would have to say, the main thing is to stay informed. Fortunately, for me, I was able to lead several financial seminars at a local church in Atlanta where I lived for 15 years, prior to my move to Florida. I remember that particular workshop because the workshop was entitled “empower your finances.” We named that workshop “Knowledge Is Power,” where we provided info for first time home buyers or people who wanted to step up to a new home. I challenged them to understand that knowledge is power, but it’s only power if you apply the knowledge. Understanding their credit report, understanding their debt compared to their income, and being patient with their decisions when weighing their options in buying their home [are points to bear in mind] as this is in most cases the single largest investment most people will make in a lifetime when buying a home.

Tell us about your experience working with and educating people on first mortgages.

Since May 23, with the new product Wells Fargo has introduced, we have had thousands of new apps in regard to yourFirst Mortgage and it’s been unbelievable. From our perspective, we aim to provide simplicity for the consumer and make sure they have a product that requires only 3 percent down payment. Looking at yourFirst Mortgage and comparing it to other lower down payment programs, the payment capacity allows the customers to have a much lower payment. For an example, if there was a situation where an individual had an FHA loan, mortgage insurance premium, plus mortgage insurance tied to the loan, yourFirst Mortgage gives our consumers the better payment option to get into homeownership.

Is there anything else you’d like to add?

I would like to say, oftentimes people are suffering in silence and are afraid to take that step toward homeownership, but those individuals should switch that energy into getting informed. Look and see what’s out there and who has their best interest at heart.