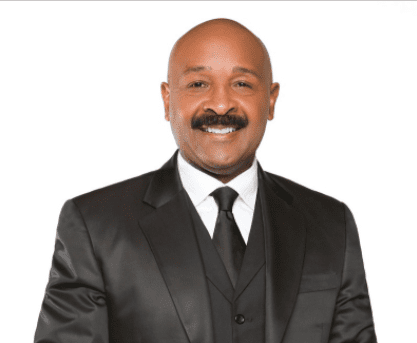

A sought-after international speaker, published author, certified coach and TV lifestyle personality, Dee C. Marshall is president of Raise The Bar LLC and founder of Girlfriends Pray Inc., an international organization of over 100K women in three countries and over 26 U.S. markets. Prior to striking out on her own, Marshall spent more than 10 years working on Wall Street in management and organizational development for Merrill Lynch, Prudential Securities and Moody’s Investor Service pre- and post-Sept. 11. She also previously worked for Johnson & Johnson and managed a third of the advertising sales division at the New York Times.

When did you truly become financially conscious?

I became financially conscious when I realized I made more than enough money to live well but I still didn’t have enough money. The problem was first my spending habits and behavior around money. It was not an issue of spending money on handbags and shoes; rather a “high consumption” lifestyle where I was just buying “stuff” and had a lot of requirements on a daily, weekly basis; the second issue was I didn’t have a limit or budget to manage discretionary spending.

What does financial success look like to you?

My picture of financial success has evolved. It used to be earning a certain amount of money, having all of my financials accounted for, managed and protected. Now financial success looks like (1) I can wake up and say “what do I want to do today” because I no longer work for a living (2) it’s when my passive income and real estate investments fund my lifestyle and (3) I have enough insurance to leave something behind — not just for family, but to a cause that I love that would be hot to leave a million to a learning institution, a nonprofit, my church or to have a space dedicated in memory to some great work.

Who taught you how to be financially savvy?

Years ago I was a member of a church with a very forward thinking Pastor and leader who was business savvy and financial savvy. Dr. DeForest B. Soaries Jr., senior pastor of First Baptist Church of Lincoln, was the one responsible because back then he launched classes on becoming dfree /Debt free through Sunday School, and that was almost 10 years ago.

When did you get your first credit card or line of credit?

Oh my! I probably got my first card while in college and I was so irresponsible. I jacked up my credit back then because that was long before I learned anything about how to be financially responsible.

What do you know about your finances now, that you wish you had known earlier?

I really wish I knew I how to save, live by a budget, pay myself first and invest my money.

If you could tell people one thing they must do to live a stress-free financial life, what would that one thing be?

Wow, there is so much I could say, but I think getting support — get someone to help you and you will immediately feel better, and feel more responsible — is critical because there’s so much to do.

What is the biggest lesson about money that you have learned?

Stop being a slave to creditors.

Please list any social media handles or websites that can be published with your feature: www.DeeCMarshall.com @DeeCMarshall on Instagram, Facebook and Twitter.

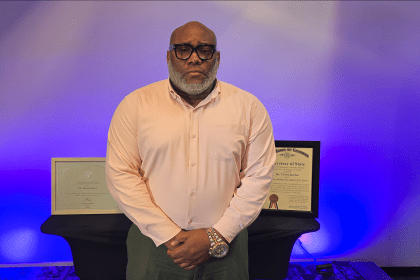

dfree® is the only strategic wealth-building system created to empower the African American community for financial freedom. Join the money and wealth conversation with dfree® founder Dr. DeForest Soaries live this Friday, Nov. 10 starting at 10 a.m. EST @mydfree (FB, Twitter, YouTube) and at www.mydfree.org. Dr. Soaries will spend the day speaking truth to power about Black wealth.