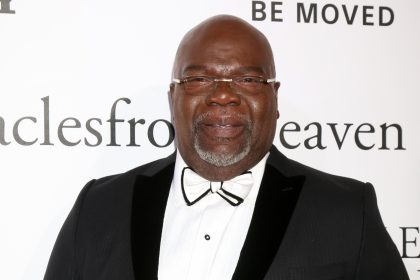

Photo courtesy of Chicago Scholars 30 under 30

Marseil Jackson helps people build credit through renting. He is the CEO of Rental Harvest, founder and CEO of the Jackson Action Coalition and the co-host of the Brunch Bunch on Inspiration 1390AM on iHeart radio.

How old were you when you started your first business?

I started my first official business at 15 years old. My parents say my first business was when I was in seventh grade and I was about 12 years old. I started a tutoring service in our backyard for my neighbor’s kids.

What was the business?

My first business at 15 was an online retail store called Off The Radar Discounts. I met a lawyer from NYC who found out about my business and asked me to write up a business proposal [and] he then would consider investing. I never wrote a proposal before, but I researched [how to do it] and wrote one. Before my 16th birthday, I had a $10K investment to help me import wholesale products from overseas.

How old are you now?

I am now 30 years old. I just celebrated my 30th birthday this past May 14th. I celebrated 15 years of being an entrepreneur and 10 years as a community activist.

What is a rent reporting service?

A monthly rent reporting service is a company that is able to report a tenant’s rent (past and present) to the credit bureau. When our clients sign up we are able to report their past and present rental history to the credit bureau. It will help them to establish credit.

How did your agency start as one of the first all-African American agencies in the rent reporting industry?

When we launched RH, we were the only Black-owned rent reporting service in the industry. No one else saw the vision to provide this type of service. When I decided that this was something that my community needed especially and not just people across the country I decided to make it happen.

What attracted you to this business?

I understand economics and the importance of financial literacy. When I first heard that the credit bureau was allowing rental data to be used to help build credit I knew it was something I needed to do. Forty percent of homes in the United States are rentals. One in 10 Americans is considered credit invisible. One in three African Americans is considered credit invisible. To be credit invisible means that you have no credit score at all.

How can this business help others?

This business helps anyone who is renting. For most people rent is their largest monthly expense and it isn’t reported to their credit report. We are able to help renters get the credit they deserve for paying their rent on time every month. For renters who are credit-invisible we are able to help them go from not having a credit score to having a credit score. The benefits of our service have been home ownership, car ownership, lower interest rates and more. Having better credit and a better credit score can open many doors for a lot of people. We’ve seen credit scores increase as low as 5 points to as high as 699 points in under 30 days with the average score-raising 40 – 50 points. When our customers are what’s considered credit invisible they usually go from an N/A (credit invisible) to a 699 credit score.

What other things are you working on?

I’m still very active in my community activism work working diligently with other community leaders to help increase services and resources to help the community financially. I believe that a lot of our issues stem from lack of economic resources for our community. I am also the co-host of the Brunch Bunch on Inspiration 1390AM with businesswoman extraordinaire Ms. Tamera Fair.

How can people connect with you?

They can connect via email at [email protected] or give us a call at 312-767-5677.