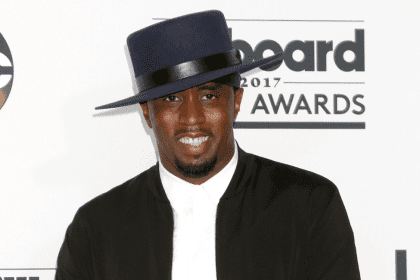

Comedian and Chase ambassador Kevin Hart is known for laughing at his pain, including financial pains. Hart has partnered with Chase to promote Hart of It All, a series encouraging people to spend moderately. Hart is encouraging people to learn more about how to handle their money and financial health.

On Sept. 22, Hart visited Spelman College to talk about the importance of financial literacy. Students were regaled with stories of Hart’s humble beginnings and hard-learned lessons about budgeting. Rolling out spoke with Hart about investments and how college students can strategically make money while avoiding piling up debt.

During the panel, you mentioned that you blew through your first big check. After you learned that lesson, what was your next major investment?

My next major investment was my first comedy special, Laugh At Ny Pain, which I funded and presented theatrically. I took the tour of money that I made and I said, “You know what? I’m going to invest in this and put it out because I feel like I can make a bigger return.” It was about $750,000 to produce and put out, and I think it made 9 or $10 million. I received more than five times the money I invested. In my mind, I’m like, “OK, this puts me in a better position to navigate my corporation and company’s structure.”

Today you encouraged students to “make their money make money for them.” How would you advise college students to accomplish that?

It’s about understanding the investment in the world of interests and savings. It’s not just putting your money in a bank account and letting it sit there, it’s putting your money in a bank account to make it work. How do you make your money work?

The key to this is understanding the world of the economy and putting your money in safe stocks that you can sit, watch and let grow. There’s such a large world that’s attached to finance and the biggest piece of information that I can give college students today is to outsource the information because it’s not going to be given to you. We have to cure the financial illiteracy that we’re suffering from. It’s not just the work that I’m doing but it’s the work that you also have to do in just being ambitious enough to find that element.

For further information on investments and financial literacy, Hart is offering knowledge on his Hart of It All platform https://hartofitall.chase.com/more-from-hart-of-it-all.htm.