Vernon Lee Jr. is a partner at the Marathon Fund where he is primarily responsible for developing deal origination outreach, fund investor relations and reporting, and facilitating investment partnerships. He is a business owner and adviser with over 25 years of experience leading and managing diverse teams as well as guiding, investing in, and developing entrepreneurs.

The Marathon Fund is an equity fund dedicated to creating high-growth, foundational businesses that embrace the diversity of talented innovators historically underserved by the private capital market ecosystem.

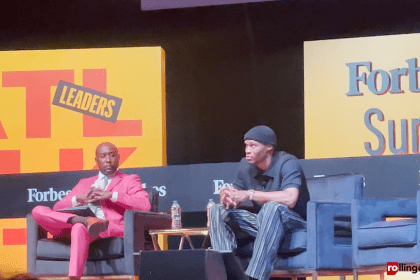

Lee spoke with rolling out about the Marathon Fund and partnering with Black Tech Week.

How has the Marathon Fund been able to partner with Black Tech Week?

From the Marathon Fund standpoint, we’re a venture capital firm investing in early-stage companies primarily in fintech, ad tech, digital media, and health tech. We’re always interested from a deal flow standpoint, and being a part of ecosystems where we’re meeting astounding founders from various backgrounds, areas of domain expertise, solving unique problems, and complicated problems. For us to be at Black Tech Week, it’s an opportunity for us to continue to lean into the ecosystem and meet with new founders. In some cases, that means building a relationship over time. We’re not transactional focused, we focus on building relationships, not just with the founders and the entrepreneurs themselves, but with our peers. The investment ecosystem is always great to either meet new peers or those that we’ve known for some time, to all be in the same place within the same ecosystem over a couple of days to get value and be able to reconnect with one another.

How are you all impacting the tech community?

Part of our focus is not just the check-writing aspect, we talk about partnering with founders and entrepreneurs. Our partnership also means providing advice, counseling, coaching and mentoring as part of the ecosystem. Part of our model for engaging with founders as we’re thinking about relationships and partnerships over time, is also thinking about the other value that we can provide that may be a strategic partner or potential customers. Ultimately, that also means from a capital raising standpoint, either in the near term or long term over several stages of capital fundraising, that we can bring our peers and other parts of our network into the space as well.