Shopaholism, commonly known as compulsive buying disorder, exacts a profound toll on individuals and their loved ones, forging a path strewn with financial strain and emotional turmoil. Whether ensnared in its grip or standing as a beacon of support for someone who grapples with this affliction, comprehending and effectively managing this condition becomes an imperative pursuit.

The allure of shopping transcends mere material acquisition, often escalating into an all-consuming compulsion. Compulsive buying disorder isn’t merely an affection for the act of purchasing; it’s an overpowering impulse, indiscriminately driving excessive purchases, regardless of necessity or financial prudence. Understanding the subtle nuances of this affliction is the first step toward navigating its intricate web.

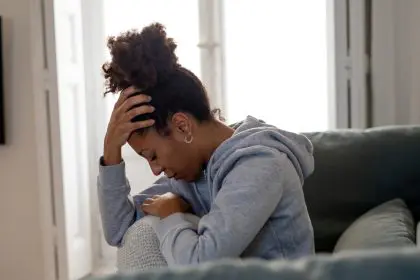

Recognizing the warning signs becomes pivotal — a tendency towards frequent and unnecessary purchases, employing shopping as a coping mechanism for emotional upheavals, facing mounting debts due to unchecked spending, or battling secrecy and guilt post-shopping sprees. Acknowledging these signs paves the way toward effective strategies for management and recovery.

Understanding Shopaholism

Shopaholism isn’t merely a love for shopping; it’s an overwhelming urge to buy, often leading to excessive purchases, irrespective of necessity or financial constraints. Identifying the signs is pivotal. Compulsive shopping might manifest as:

– Excessive Shopping: Frequent and unnecessary purchases beyond one’s means.

– Emotional Triggers: Shopping to cope with stress, anxiety, or other emotional highs and lows.

– Financial Strain: Accumulating debts or neglecting financial responsibilities due to excessive spending.

– Secrecy and Guilt: Hiding purchases or feeling remorseful post-shopping sprees.

Strategies for Self-Management

1. Recognize Triggers

Understanding emotional triggers can help curb impulsive buying. Keep a journal to note feelings or situations that prompt the urge to shop excessively.

2. Budget and Plan

Create a realistic budget and stick to it. Plan purchases mindfully and prioritize needs over wants. Set specific spending limits for different categories.

3. Delay Gratification

Adopt a waiting period before making non-essential purchases. This helps evaluate necessity versus impulse.

4. Find Alternatives

Explore activities that provide fulfillment without spending, such as hobbies, exercise, or volunteering.

Supporting a Loved One

1. Open Communication

Approach conversations about shopaholism with empathy and understanding. Offer support without judgment, encouraging open dialogue.

2. Assist in Seeking Help

Suggest professional guidance like therapy or support groups. Encourage seeking help from a counselor specializing in compulsive behaviors.

3. Financial Assistance

Assist in managing finances by offering to create budgets or exploring debt management options together.

Seeking Professional Help

Professional intervention can significantly aid in managing shopaholism. Therapists specializing in behavioral disorders or addiction can provide:

– Cognitive Behavioral Therapy (CBT): Identifying triggers and developing coping mechanisms.

– Support Groups: Engaging with others facing similar challenges can offer valuable support and strategies.

Confronting shopaholism necessitates a holistic approach that intertwines self-awareness, a robust support system, and at times, professional intervention. Identifying triggers that fuel impulsive spending, embracing healthier coping mechanisms, and fostering transparent communication constitute the bedrock of effective management strategies. These pillars provide the scaffolding for not just curbing excessive shopping but also for reclaiming autonomy over one’s finances and emotional equilibrium.

This story was created using AI technology.