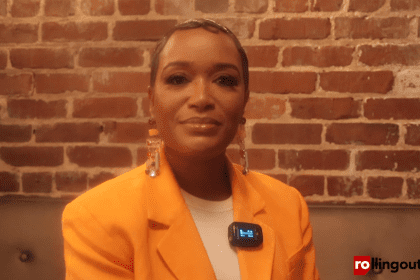

Katie Saez is Truist’s regional president in Georgia. She delivers financial solutions to business clients in the state. On Feb. 29, the Truist Foundation announced a $2 million investment in the Russell Innovation Center for Entrepreneurs (RICE) to foster mentorship, offer essential business resources, and support Black entrepreneurs. This investment broadens their access to critical capital and financial literacy opportunities. The day also featured a panel discussion on how Black entrepreneurs can secure access to capital and business resources.

Saez spoke with rolling out about small businesses having access to capital and how banks and businesses can build better relationships with each other.

Why is having access to capital important as you build your business?

Having access to capital as you grow and scale your business is really important, but also important is having a really good network of advisers. Whether that’s the people within your company or your financial partner, sometimes it’s your spouse, sometimes it’s your community, they are helping you navigate the unpredictable waters of being a small business owner can be so valuable. We talk at the bank about the lifecycle of a business, and here at RICE, they’re often working with companies and ideas that are in that really early stage of their lifecycle. It’s one in which they’re navigating who their customer base is, where their sources of revenue are coming from, and where are their sources of capital coming from. They’re navigating how to get the right employees and identify the right partners. That’s really important work that RICE is doing. But as a company or an idea grows and evolves and becomes more than a high growth stage or perhaps more in a stable or more mature stage, there are resources in the community to help that business navigate that particular segment of its lifecycle.

How can small businesses and banks build a better relationship with each other?

The way that banks work with businesses has evolved over time. It used to be that the only way that you would interact with the banker or get access to a loan, or maybe open an account was by walking into what we call a brick-and-mortar branch. While we’re still proud to have over 220 branches here in Atlanta, we know that the way that our clients need and want to interact with us has evolved. We have a really robust digital platform that our clients often interact with us directly through either by phone or perhaps on a cell phone or a laptop. The way that we’re interacting with our clients is very different, and it’s because we want to meet them where they are. We want to be respectful of their time. But we still want to be advice-driven; we still want to be a partner. Whether it’s walking into a branch or it’s engaging with a bank or through one of our digital channels, we take great pride in being a resource to small businesses here in Atlanta.