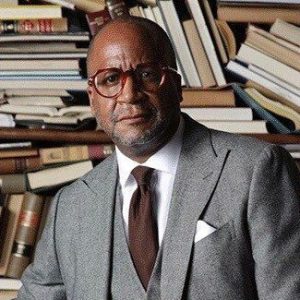

Amber Banks-Bond is a president and a warrior. She’s at war with those who are undermining black and brown communities, the underserved, those that have been left outside of the financial system and she took a few minutes to speak with rolling out Publisher and CEO Munson Steed about DEI initiatives and how there are those using the laws that were set up to benefit civil rights to undermine them.

Munson Steed: Hey, everybody! This is Munson Steed and welcome to a Seat at the Table. Where I and my guests discuss and talk about the opportunities or the lack of opportunities, or the attack on opportunities by an individual, in this society. We know that this society has the obligation to give each person their freedom and there’s a constitution that should serve that.

We also know that there have been some systematic disparities that have existed for years, from free labor, to redlining, to the inability to secure loans even to this day, to the lack of funding in the VC, and venture capital community. Grants and corporations who want to even see and end systemic racism often are left now, it seems, under attack.

So I’d like to discuss this with my dear sister because CDFIs play a huge role and if you could describe at least the role that CDFIs and the funding community for those individuals who need micro loans, those individuals who might need help with their first time, creating wealth for their families, and well for future generations. The one, the only, the super, my dear sister Amber Bond, how are you?

Amber Bond: I’m doing so well, Munson, and thank you so much for taking the time to talk with me and including me in these discussions. I’m excited to be here with you today.

MS: Let’s get right to it. There is an individual last name Bloom, and there is a dear sister who truly wants to empower women. She creates a fund with other women, corporations come. Can you kind of give us a narrative so that we can both educate, amplify, resist, rest, reset, and do it again?

AB: Sure, yeah, happy to do that. I mean, we’re in really a scary time. I like maybe many, coming out of, we’ll call it the Civil Unrest in 2020, after the murder of George Floyd. And we saw what we thought was a country in reckoning, finally facing racism, coming to terms and collectively bringing some solutions to the table. We saw corporate commitments. We saw individual donations to DEI initiatives. You couldn’t go anywhere without having that conversation. It was at nearly every dinner table in the country. It was. It was unavoidable, so to speak, or so we thought.

And now, just four years later — four short years later — we see so many in this country. We’ll say that there are Conservatives, not just mounting an attack, but executing a coordinated attack against those very DEI initiatives, that in many cases we’re just getting mobilized. And so we’ve seen that from Attorney Bloom, in the case against affirmative action that effectively ended it for an education system and college admissions. We saw it against the Fearless Fund and their grant program focused on black women and now we see it again. Happening against the Smithsonian and the Latino focus internship program and I think we will see more, right?

These cases where Conservatives like Edward Bloom, are using the very legislation that was meant to protect us, Help us, bridge the gap is now being used to undo the little progress that we have made all in the name of civil rights. And so, here we are as organizations that have set a mandate that this is going to be our focus, black and brown communities, the underserved, those that have been left outside of the financial system. We’ve made these stance. We’ve made these commitments and we advocate for our communities. And we have, I’m not gonna say, a new opposition. I’m gonna say, opposition in a different form, right?

But it also energizes us in a way. None of us, I think, expect this road to be easy, right? If equity was easy, we’d have it by now. But we feel charged, and I think all the more united around this issue is, how do we continue the fight for DEI initiatives that we know are somewhat moving the needle, despite the statistics that still show wealth indicators, health indicators for black people are still trailing.

MS: You said a lot there but getting a seat at the table. Why is a CDFI and probably wanna let anybody who we’re using acronyms know what it is. Why it’s important? So that you could also, those who are able to hear my voice and see this conversation dispel all rumors that one person pulling themselves up by the boots is not enough, when we know that we want to see all boats, all tides rise as a collective versus the constant mirroring of this illusion, that the success of 10 black billionaires, compares to a thousand white billionaires. So black people are okay.

AB: Absolutely. So yes, I can certainly start off and just kinda talk about CDFIs and why they are a crucial agent in our fight for equity. So CDFIs are community development financial institutions. This is the designation that they get from the Department of Treasury. It means that they are mission focused organizations or companies that have in their mission statement outlined specific groups, they are targeting to help and serve. Most of them are loan funds focused on small businesses.

So they provide technical assistance and that’s just a fancy way of saying business support services there to help you coach you, be your guide, and then they also provide capital. So they are doing small business loans. It might be micro loans, $50,000 or less that most banks just won’t touch because of the time it takes to do them, and the extra effort it takes to do them. They can have a focus on startups. So some banks and traditional institutions won’t touch a business unless it’s of a certain age, maybe 2, or at least 3 years.

And so those we’ll say, high risk factors, but we know that that is being dispelled daily, but they exist to help folks that have these high risk factors that traditionally are barriers to access to capital, have an opportunity. An opportunity to start their business, to grow it, to garner additional income for their households, and to fill the trust gap quite honestly. Because if you’re like me, your parents didn’t trust Banks, your grandparents definitely didn’t trust the bank and they kind of passed down to us.

We weren’t taught to believe in or trust the banking system and to pursue alternatives. And so CDFIs exist to fill in that trust gap, be a trusted source of capital and a guide through that process. And what we have seen is that black lead CDFIs are particularly good at doing this kind of impact, reaching black entrepreneurs, doing black owned development projects, bringing additional affordable housing inventory into the communities that they serve. For example, within our membership, within our network. We have about 80 certified community development financial institutions that are all black led meaning their CEO or their President identifies as African American.

And what we’ve seen just in collecting, aggregating the data from our members is that the majority of them are located inside of a justice 40 community. So inside of an underserved, designated community, so they’re in the space. They’re not just saying they serve the people. They’re with the people. They are majority minority serving. So somewhere between 70 and a 100% of the people that they serve with those technical assistance programs or loans that are deployed from those organizations are to minorities. So they’re finding a way. They’re doing a cultural, they have an immense amount of cultural competence, right?

They know how to create products and services that are tailored to black folks. They’re good at it. They’re getting repaid. They’re showing that it’s sustainable. They’re dispelling all the myths that exist around the high risk factors that plague most black entrepreneurs and individuals trying to achieve financial equity. And so we exist to support them if we say, well, if they’re doing it on maybe hyper local and regional levels. If we can help bridge the access to capital gap for them, then everybody wins. So that kind of rising tides, you know, floats all boats, so to speak, or raises all boats. We, but at the same time we know that Black led CDFIs in terms of assets under management trail white counterparts, 6 to one. So there’s, something ain’t right, as they say…somewhere.

MS: The math’s not mathing. When you think of, thinking of young fearless fund founder, and you’re literally thinking you’re on a path of recognition, reconciliation, respect, repair, removal. Ending the traumatic experience of America, being a black woman working hard to raise and then find this one opportunity with this corporation, who at this particular moment found some level of consciousness, and then you’re being attacked. How does that change the trajectory for many black women who had hoped to receive that Grant? What do you think the impact is? Sort of, as it relates to having the seat at the table? Somebody has kind of not only built it, moved the table, shrank it, and then kind of made it so you can’t get to it.

AB: We can’t even quantify the impact. We can’t even quantify how impactful these attacks are. In simply by nature, they’re having to change the title of the program. They’re having to change the language of it, because for the first time for many, there were programs established just to support us. For the first time people were looking at the facts and statistics and saying, if we’re not intentional about getting capital into the hands of black women, we won’t see this change into…

In 2021, a third of a percent of VC capital went to black women. That’s, it should be embarrassing. It should be a crisis that all Americans want to solve, especially when we know in terms of just revenue and income increase that black business, they’re adding to this economy. It should be a national crisis but instead, it’s an alert to some that there is a level of unfairness that needs to be addressed. And so we can’t quantify the impact, because not only is this disrupting program specifically designed to support black women and help them overcome the double disadvantage they are facing.

We don’t know how many programs that were underway or being developed, that it stopped because they’re fear tactics, right? That’s all this stuff is. It’s fear tactics, and it’s designed to get corporations to backpedal, individuals to backpedal on their commitments and to stop new flow of funds into these types of projects and so I hate it! I hate how discouraging it has to be. I hate how harmful it is to the ecosystems that were built to help black women, when for so long we have struggled across the board to get access to capital for our businesses.

MS: Oh, well said. You have that look, that when you’re thinking of future and why and how we react. What should be our first 3 things to do to address this conservative movement? which I think, in controlling the narrative, we have to use probably language that is much more honest. I think calling someone a Conservative might mean, I’m a teetotaler. I think that to me it’s a hateful, oppressive action to move in that direction.

So we gotta call hate, hate where it exists. unless hate you If I want you to have less, right? And I think that when we don’t say these are hate groups. I think we begin to get that softness but if we’re going to have seats at the table. We’ve got to call something what it is and I believe that it’s a hateful tool and cannot be disguised in the guise of conservatism. So how do we address hate as a tool of wanting an entire race of people again, both black and brown to have less society that already offers up less? And the data just says that.

AB: Right, that’s correct. First thing we can do is exactly what you are suggesting, right? Is not to downplay what is happening, It’s not small, it’s not insignificant. These attacks are coming from a place of not pursuing equity, as they would like to mask them. But they’re coming from a place of trying to take away from the little that has been obtained. It’s an attempt to reverse traction. It’s an attempt to stop progress. And it’s that serious, I think, like you said, the first thing is to call a spade a spade, that we know what’s happening. And we’re gonna be honest about it and speaking truth to power.

Think the second thing is to join in advocacy for DEI initiatives, and that could look a number of ways, right? That could be tapping into organizations that exist and that are doing this work on the front lines, like the Alliance. Tap into the information that’s flowing from these organizations. Understand the messaging and jump on board. Use your voice. Don’t be silenced, complaining amongst friends in person is one thing, but when you can truly join an advocacy effort. It goes a long way in uniting our voices against these things.

The Alliance helped to create the community, the community builders of color coalition, which is a coalition of about 19 BIPOC led organizations across the country that are all focusing on minority issues in their respective areas. And we feel like this is extremely important because it’s not just a black issue. It is a brown issue. It’s a minority issue across the board, just as we’ve seen with Smithsonian right? It’s already starting to cross over. It’s already starting to cross over.

So if we can recognize this as a full frontal attack, we can unite and fight back together. The other thing, I would say, is time and talent. I know this is often sometimes looked over but if you have expertise in an area, time or talent, volunteer it, volunteer it. Non-profit organizations that do this work are often very under resourced and the more the community comes together to support the work that we’re doing. The more we can do, right? So we join the epic advocacy, efforts and time and talent, volunteering to support. The first 3 things we can do.

MS: Well. I really appreciate you sharing these insights. I really appreciate you taking the time to have a seat at the table and I really admire the courage that you have to speak truth to power. I know that Fannie Lou Hamer and Dorothy Hyde and Barbara Jordan would be very proud of you. And the fact that justice is being something that is being addressed in making sure that there is a seat at the table. I’m Munson Steed, this has been a wonderful interview, my dear sister, Amber Bond. Thank you so much for coming on to see the table here rolling out.

AB: Thank you so much for having me, Munson.