In a recent survey conducted by the Black Census Project, over 200,000 participants highlighted a significant issue that resonates deeply within the Black community: the lack of affordable housing. Jeffrey, a participant from Atlanta, succinctly stated, “There’s just no inventory for affordable housing at all.” This sentiment reflects a broader concern that has been echoed by many, emphasizing the urgent need for solutions in the housing sector.

The homeownership gap: A historical view

The homeownership gap for Black Americans is alarmingly larger now than it was in 1968, the year when housing discrimination was still legal. This disparity is not merely a statistic; it represents the systemic barriers that have historically hindered Black individuals and families from achieving homeownership, a critical component of economic stability and generational wealth.

Today, many Black households are burdened by high housing costs. On average, a significant portion of their income is allocated to rent or mortgage payments, leaving them with less than $15 a day to cover essential needs such as food, transportation, healthcare, and savings. This financial strain is exacerbated by rising housing costs, which have outpaced wage growth, further complicating the path to homeownership.

Corporate greed and housing disparities

While some politicians may point fingers at immigrants for the housing crisis, the reality is far more complex. The primary driver of this crisis is corporate greed. In numerous Black communities, large corporations and investors are purchasing land to develop expensive condos and apartments, while simultaneously acquiring homes that require rehabilitation. Unfortunately, many of these properties remain abandoned, and local and state officials often fail to address these issues.

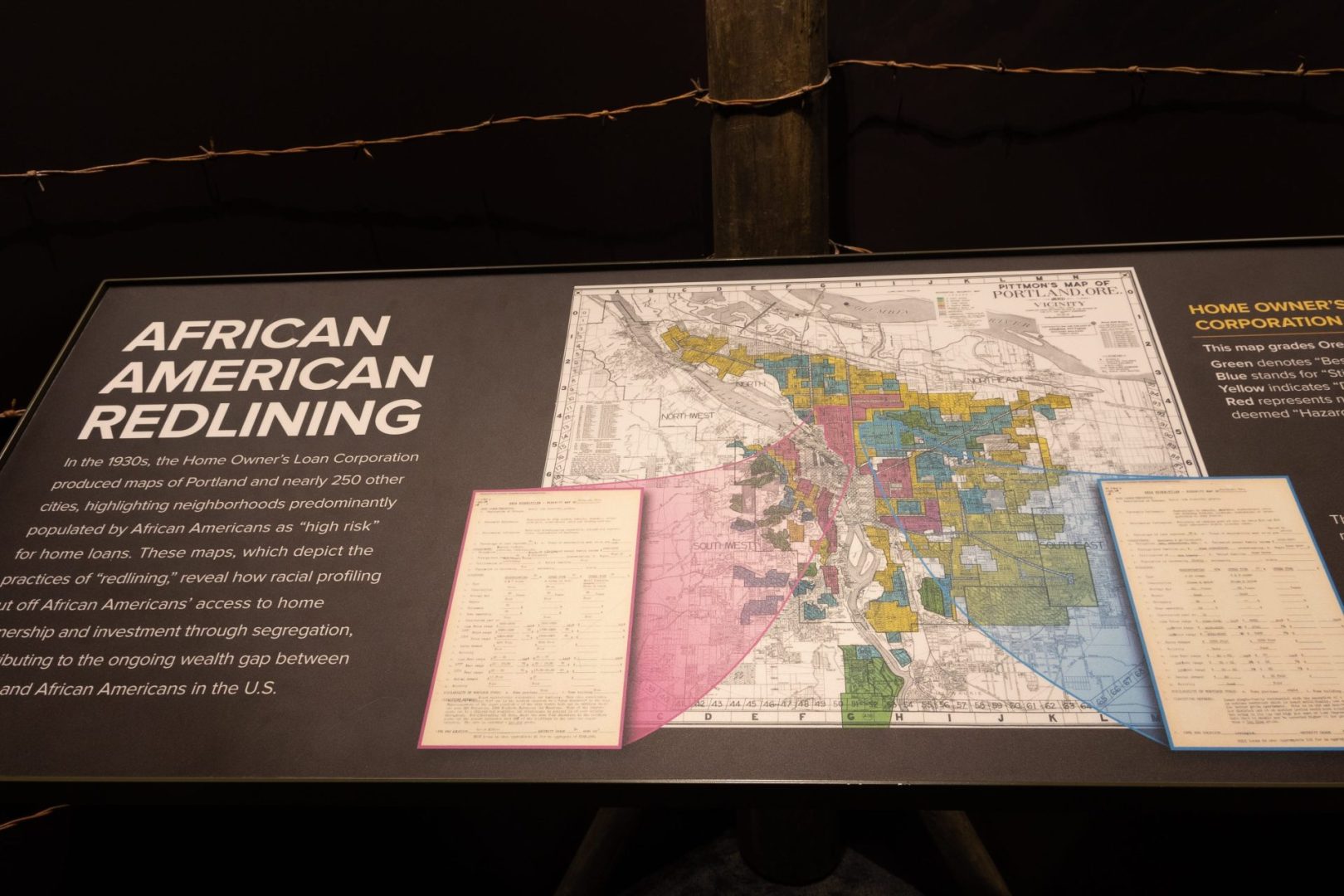

Moreover, the legacy of discriminatory practices such as redlining continues to haunt Black communities. Homes in predominantly Black neighborhoods are undervalued by an average of $48,000, resulting in a staggering cumulative loss of $156 billion. This devaluation, coupled with income barriers and insufficient credit access, creates a formidable obstacle for Black individuals aspiring to own homes.

Proposed solutions for affordable housing

In response to the findings from the Black Census Project, the Black to the Future Action Fund has put forth a Black Economic Agenda that outlines several policy solutions aimed at expanding access to affordable housing for Black Americans. Here are three key recommendations:

1. Expand homeownership options: One of the most effective ways to address the housing crisis is by developing programs that preserve and expand housing affordability. Vice President Kamala Harris recently proposed a plan to construct three million housing units through direct investments and tax incentives, which includes down payment assistance of up to $25,000 for qualified buyers. This initiative has the potential to make a significant impact, but it requires robust support from local governments to be successful.

2. Strengthen rent regulations: With over half of Black renter households classified as cost-burdened, it is crucial to implement stronger rent regulations and eviction protections. States should consider passing rent stabilization laws to shield tenants from exorbitant rent increases and reduce the risk of displacement. Additionally, providing legal representation and mediation services for renters facing eviction can help mitigate the crisis.

3. Fund affordable housing trusts: Affordable housing trust funds are essential for supporting the production and preservation of owner-occupied housing. Currently, only 14 states have laws encouraging local jurisdictions to allocate public funds for affordable housing initiatives. Expanding these funds can provide much-needed assistance for down payments and other housing-related needs.

Call to action for policymakers

It is imperative for candidates and lawmakers at all levels of government to prioritize the housing concerns of Black voters. As a critical voting bloc, Black Americans are poised to influence elections significantly. Addressing their housing needs is not just a matter of policy; it is a moral obligation.

Now is the time for policymakers to rewrite the rules to center Black individuals and their needs. Black voters must also engage actively in the electoral process, supporting candidates who advocate for real solutions to the housing crisis. Together, we can work towards ensuring that every American has access to a decent, affordable place to call home.

The author, Kristin Powell, is the principal of the Black to the Future Action Fund and Black Futures Lab.