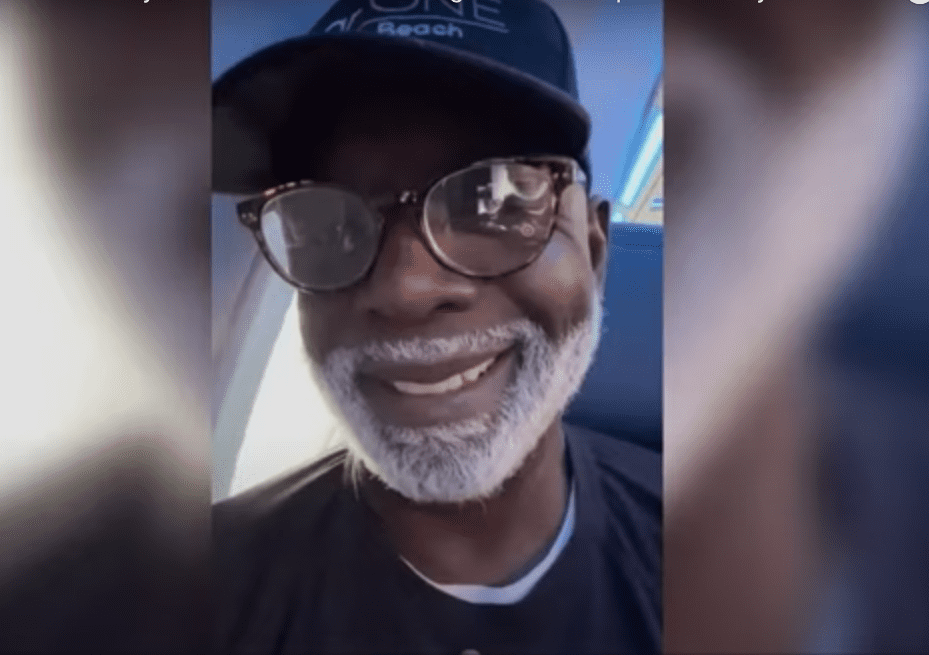

Peter Thomas, who gained prominence on Bravo’s “Real Housewives of Atlanta,” has been sentenced to 18 months in federal prison for failing to pay over $2.5 million in employment taxes. The restaurateur’s case highlights deeper concerns about financial literacy and business management in urban communities.

A legacy complicated by financial missteps

As the owner of several upscale establishments including Club One CLT, Sports ONE and Bar One in Miami Beach, Florida and Baltimore, Thomas built a reputation for creating sophisticated social spaces. However, between 2017 and 2023, he neglected to pay employment taxes, including more than $1.7 million that had been withheld from his employees’ paychecks.

The consequences of this financial negligence extended beyond mere paperwork. Federal prosecutors revealed that Thomas diverted these funds toward personal luxuries, spending over $250,000 on high-end brands like Prada and Louis Vuitton. This pattern of behavior led to his guilty plea on one count of failure to pay trust fund taxes.

The weight of accountability

U.S. District Judge Kenneth D. Bell Sr.’s courtroom became the setting for Thomas’s reckoning with his actions. Despite his attorney’s request for a reduced sentence and submission of character references from community members — including spa owner Nia Banks — the judge maintained the significance of the offense. The sentence includes two years of supervised release and mandatory restitution.

The timing of this legal judgment carried particular poignancy for Thomas, as it coincided with his 50th anniversary of arriving in the United States from his homeland of Jamaica. This milestone — instead of being a celebration of achievement — became a moment of reflection on choices and consequences.

Impact on the culture

Thomas’s case resonates particularly within urban entrepreneurial circles, where his establishments often served as gathering spaces for professionals and cultural tastemakers. His venues — known for their upscale atmosphere and attention to detail — represented a specific vision of success and sophistication.

However, his relationship with these communities has been complex. While some lauded his role in creating elevated social spaces, others criticized his controversial comments about cultural differences between cities like Baltimore and Washington. These remarks raised questions about his understanding of and commitment to the communities he served.

A cautionary lesson for entrepreneurs

Through his experience, Thomas offered a crucial piece of wisdom for business owners: prioritize payroll tax obligations above all else, including rent. This advice — born from costly mistakes — emphasizes the fundamental importance of proper tax management in business operations.

His story serves as a powerful reminder that success in the hospitality industry requires more than just creating attractive spaces and cultivating a high-profile image. It demands meticulous attention to financial obligations and a deep understanding of business operations.

The sentencing of Thomas represents more than just individual accountability; it highlights the critical need for financial education and proper business management within entrepreneurial communities. As urban professionals continue to build and expand their business ventures, his case stands as a sobering reminder of the importance of maintaining financial integrity while pursuing entrepreneurial dreams.