Tiffany Haddish gets candid about makeup struggles

Tiffany Haddish needs to be in a “good space mentally and spiritually” before she can get her makeup done. The entertainment industry often requires performers

Tiffany Haddish needs to be in a “good space mentally and spiritually” before she can get her makeup done. The entertainment industry often requires performers

Tiffany Haddish wants to date a successful business owner. The comedian has become increasingly selective about her romantic prospects following her successful career in Hollywood.

The credit scoring system stands as a powerful gatekeeper to financial opportunity in America, with significant implications for wealth building across different communities. As of

The dawn of 2025 brings renewed focus on America’s enduring economic disparities, particularly the substantial wealth gap between African American and white households. Current data

The credit system has a long history of inequity, particularly affecting Black Americans. A recent study by Varo Bank highlights the persistent disparities faced by

As we approach 2025, the importance of building generational wealth within the Black community cannot be overstated. Historical disparities have often hindered financial growth, making

Dina Harris is a phenomenal story — a woman who picked herself up from a very low credit score, learned how credit could work for

Since 2000, Jacqueline Burau has honed her professional skills and has worked her way through the ranks within the LISC organization. Since 2012, she has

Moses Harris has been motivated by his desire to uncover the overlooked — owners of Black middle market companies. As Wells Fargo‘s Black/African American Segment

T-Pain is an amazing singer, and he has some incredible skills as a songwriter for tracks that aren’t his, particularly in country music. Unfortunately, we’ll

Becoming a millionaire stands as a pinnacle of achievement for countless individuals, a distant summit seemingly reserved for a select few. Yet, the path to

Meet Aneesa Getaneh, a dynamic force in the world of finance, entrepreneurship and women’s empowerment. Armed with a master’s degree in social entrepreneurship and change

In the contemporary landscape where personal mobility is paramount, owning a car is often deemed a necessity. However, for individuals with a less-than-ideal credit history,

The journey to buying your first home is an exhilarating and life-changing adventure. However, before you can walk through the front door of your dream

Erica Hughes is the senior director of multicultural marketing at Ally Financial where she is mostly responsible for leading the overall vision and strategy. On

Credit guru and entrepreneur Kenny “SmittyTheGoat” Smith took a different path than his peers in Chicago. After realizing his basketball career was limited, he pivoted

Credit Reversal Guru offers an innovative way to reverse credit instead of deleting or removing negative items. A credit reversal example involves someone who has

The CEO of Loop Investing Technologies Sean LeDree is passionate about financial literacy. He shares his insight on the importance of financial education and his

From your favorite rapper, athlete, or reality star, James Hunt, also known as the “Credit Guru of Atlanta,” has worked with many of them. Hunt

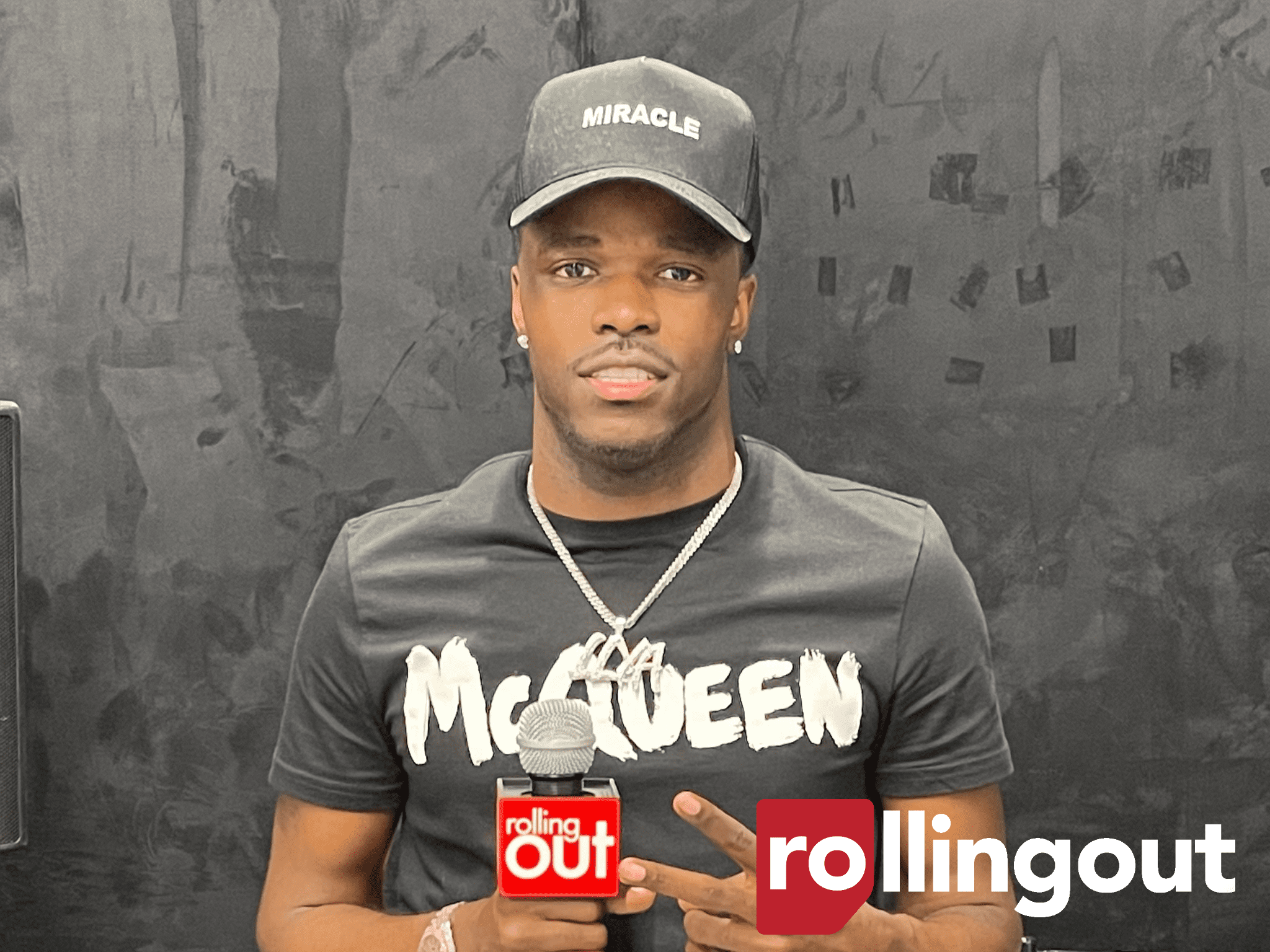

Photo credit: Photographer Faree Rolling out interviews Remus Jackson IV about The 850 Life group. He helps build people’s credit to achieve an 800 credit