With the recent turmoil and the instability of the global marketplace, many U.S. banks have been able to weather storm but just barely. In both Europe and the United states the picture is the same: banks and investors versus the common man and homeowners, or banks and investors versus the nation.

With the recent turmoil and the instability of the global marketplace, many U.S. banks have been able to weather storm but just barely. In both Europe and the United states the picture is the same: banks and investors versus the common man and homeowners, or banks and investors versus the nation.

In the United States, recent indicators suggest that Bank of America may be sinking back into troubled waters. It was downgraded again on Tuesday, Aug. 23, which means this was the company’s fourth analyst downgrade in the last three trading days, according to Bloomberg. This time it came from Independent Research GmbH analyst Stefan Bongardt, who lowered his recommendation to “sell” from “hold.” CLSA analyst Mike Mayo, issued the second downgrade for Bank of America in the less than a month. Mayo cut his target price to $8 from $11. On Friday, Aug. 19, Bank of America was downgraded by equity analysts from Standard & Poor’s and Wells Fargo.

Although Bank of America shares were higher on Tuesday after losing more than 20 percent Monday, it still has issues pertaining to the mortgage-backed securities it invested in as well how to recoup the over $16 billion of market value it lost as its shares fell after the downgrade of the United States credit rating, and a lawsuit filed by American International Group, the insurer of the home loans.

BOA is involved in roughly 20 percent of the country’s home loan market and now they have to deal with a $10 billion AIG lawsuit accusing the bank of “massive fraud.” In concert with a possible $8.5 billion settlement for outstanding home loan claims, in July of this year. The concern is that Bank of America may need to raise additional equity given its heavy exposure to home loans underwritten in the middle of the decade, many of them through Countrywide, which it acquired in early 2008, which is where many of the problems arise.

A number of institutional investors, along with Fannie Mae and Freddie Mac, want Bank of America to repurchase bad Countrywide mortgages, which they say failed to meet underwriting standards.

Obama gave BOA part of the stimulus package, did he not? The question remains if Bank of America is safe or if it is in peril equal to its European colleagues in France, Spain and Italy. There is still a massive uncertainty about BOA and many have no idea how much debt is on their books whether from mortgage-backed securities, interest rate swaps or other complex financial papers.

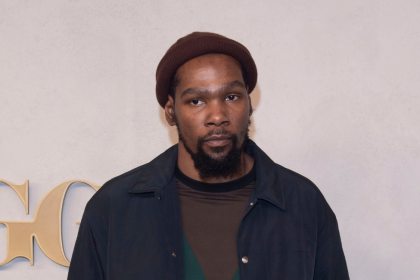

–torrance t. stephens. ph.d.