Tax season is over, nearly half of the year is over, and many of us have yet to move forward on the financial goals that we have set for ourselves and our families. This is because, to advance in life, we need more than just goals — we need strategies. We’ve been led to believe that knowing more makes us do better. But when it comes to finances, having a plan and sticking to it is what makes us do better. Knowledge is power, but knowledge without strategy is just acquired information. You can know how to balance a checkbook, but if balancing your checkbook every week isn’t part of your financial strategy, you won’t be motivated to do it.

You owe it to yourself to make financial freedom your reality, but understand that this will take strategy as well as discipline. Take charge of all of your financial matters. You owe it to yourself to know how much money you have coming in, and how much money you have going out. You owe it to yourself to have a financial snapshot and goals with dates attached to those goals. You owe it to yourself to know the good, the bad and the ugly about your financial situation, and tackle the bad and the ugly bill by bill, task by task. I say this not as someone who thinks they know what you may be going through, but as someone who has been where you may be right now. I was once drowning in debt, and I changed my situation by taking an honest look at it, changing the habits that created it, and developing a strategy to overcome it. I want to share what I have learned with as many people as I can so that their lives can be transformed the way mine was once I took control of the resources that I had.

Everyone knows the story of the prodigal son. In this story, we find a timeless family triangle: an industrious father who has done well for himself, an impatient son who makes a fool of himself, and a jealous brother who gets beside himself. The story’s catalyst is the demand by an impulsive young man for immediate access to the inheritance he’ll receive upon his father’s death.

After the young man gets his money, he quickly turns his new prosperity into devastating poverty. It doesn’t take long for him to burn through his cash with reckless living. He didn’t play the long game with his inheritance. Like so many of us, he was short-sighted and focused on what he wanted “right now.” This prodigal son’s core problem is his impatience. His thirst for immediate gratification. This is a problem we must address as we look at how we are spending money. Are we buying what we need, or is impatience making us buy everything that we want when want it?

It is impatience that drives us to buy things we can’t afford and use high-interest credit cards. When we spend money that we don’t have, money that we don’t know when we are going to get, we are creating a nightmare for ourselves and our families. We are building a legacy of debt-induced stress. We are living above our means, and lower than our capabilities.

When the prodigal son realized the mess that he made, he escaped from his self-imposed nightmare and went home to his father. He realized that the life that he was so eager to live wasn’t the life he wanted for himself after all. It wasn’t a good life, so he changed.

If you want to change your financial situation for the better, I want to help you with a strategy to do so. The first step is to admit where you are, wherever that is, and gather bills, bank statements, and everything essential to understanding your current financial position. You can’t change what you don’t face, so facing your financial situation is step one.

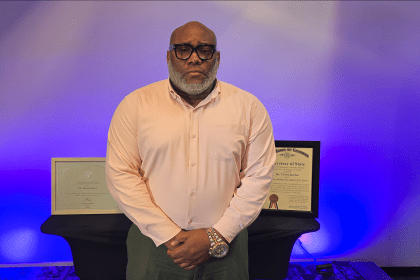

Dr. DeForest B. Soaries Jr. is the author of Say Yes to No Debt: 12 Steps to Financial Freedom, senior pastor of the First Baptist Church of Lincoln Gardens in Somerset, New Jersey, and founder of the dfree® financial freedom. For more information, visit www.mydfree.org.