We all know that access to capital is one of the biggest struggles that Black entrepreneurs face when trying to start and sustain their businesses.

In response to this problem, Comerica Bank has decided to do its part in supporting Black-owned small businesses.

On June 19, 2020, Comerica Bank announced its $1 million commitment to the National Business League (NBL). Founded by Booker T. Washington, NBL is the first and largest nonprofit, non-partisan, and non-sectarian, Black business professional and trade association.

The donation is part of a four-year-long national partnership that will launch the Black Capital Access Program (BCAP). The initiative will assist Black businesses across the country to gain access to capital. BCAP will serve as an online platform for Black-owned businesses with resources like access to capital toolkit, financial planning information, a variety of technical services, webinars and more.

Speaking about the partnership, Curt Farmer, Chairman and CEO, Comerica Incorporated and Comerica Bank, detailed the difficulties Black small business owners face and why they stepped up to help.

“Small businesses face a myriad of inherent challenges to open their doors and remain viable, and the current conditions due to COVID-19 only deepened those issues especially among African American business owners,” said Farmer. “We believe our partnership with the National Business League will become crucial in helping many Black-owned businesses and entrepreneurs recover and survive this turbulent time.”

The NBL promotes economic enterprise and financial literacy for African Americans and across the African diaspora.

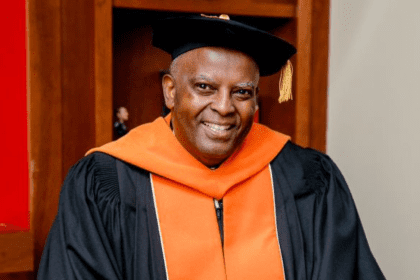

“Capital access remains the most important factor limiting the establishment, expansion, and growth of Black-owned businesses,” said Ken L. Harris, Ph.D., President/CEO National Business League, Inc. “As part of the organization’s mission to eliminate institutional, structural and systemic barriers to capital, it is important to develop public and private partnerships to address the financial burden on Black entrepreneurs who are trying to keep their businesses thriving in today’s economy, in response to the COVID-19 pandemic.

Over the next three months, Comerica will launch a program pilot in its primary markets of Arizona, California, Florida, Michigan, and Texas. By 2021, the program will be available in all 50 states.