On Oct. 19, CEOs from Wells Fargo and Operation HOPE hosted a ribbon-cutting ceremony to welcome the community to the nation’s first redesigned Wells Fargo branch with a focus on programs and resources for individuals who are “unbanked.” Unbanked people are those without a mainstream banking account and “underbanked” people are those who have a bank account but still use costly alternative services, such as check cashing.

The revamped branch is part of Wells Fargo’s Banking Inclusion Initiative to help remove barriers to financial inclusion for African American, Hispanic, Native American and Alaska Native households, which account for more than half of the unbanked households in the U.S.

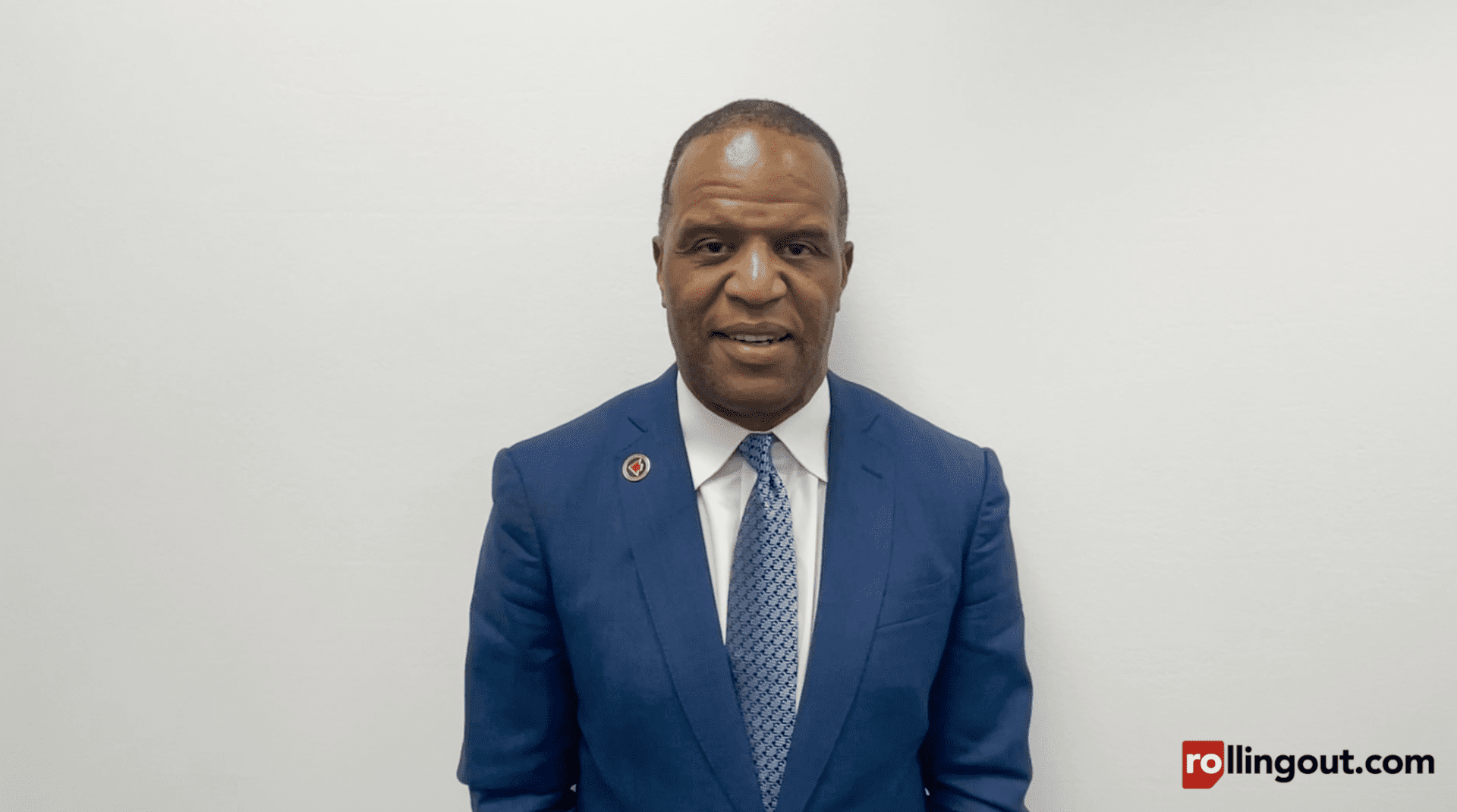

John Hope Bryant, the CEO of Operation HOPE, spoke with rolling out about the partnership.

Tell us about this partnership with Wells Fargo.

This is our 200th location, and it is literally a dream come true. This office will move credit scores for our people 45 to 60 points in the first year. This office will reduce the debt of somebody making $50,000 a year by $2,000. This office will increase savings by $200 to $500 for somebody who doesn’t have $400 for an unplanned event. If you make $50,000 a year, increase your credit score by 50, to 60, to 70 points, reduce your debt by $3,000 and increase your savings between $200 and $1,000, [and] you’ve changed your life. Now, the bank can get out of the “no” business when they say “I’m sorry, I can’t approve you” to being in the “yes” business when it comes to being approved for homeownership.

You talked about financial health in your speech. Why is that important?

Financial health leads to real health. One cause of divorce is money. One cause for heart attacks is stress. A cause for stress is money. Why are most Black people obese? We’re eating bad food. We’re eating bad food because it’s cheap. We’re feeding a family of five, four nights a week. That’s not real food, it’s processed food, but you can do it for $9 or $12. We have to get people to do better, so they live better, and live longer. My community credit score index data shows that we’re living 20 years less in poor neighborhoods. Being poor is bad for business, your pockets, and it appears bad for longevity. Money is everywhere, but we don’t understand it, and that has to change. That’s why we need the power of the media. Dr. King would never have had a movement without the help of the media. We have to make this mainstream. We have to make this a normal, everyday topic.