In partnership with Fifth Third Bank, the Association for Enterprise Opportunity (AEO) is promoting economic mobility in 10 predominantly Black neighborhoods through the Empowering Black Futures Capital Readiness Program. The initiative is part of Fifth Third’s larger Empowering Black Futures Neighborhood Program, a $180 million commitment to deliver comprehensive support in lending, investments and philanthropy in neighborhoods across the Bank’s retail banking footprint.

Focusing on neighborhoods that have historically experienced disinvestment, AEO selected two entrepreneurs from each neighborhood. The 20 participating entrepreneurs will work closely with AEO over the next several months to stabilize and grow their businesses. Each entrepreneur will complete Business Health Assessments, access personalized learning plans through AEO’s online learning platform, RESILI™, and receive trusted guidance with AEO’s network of small business coaches in an effort to strengthen key areas of the business that will better prepare them for additional growth capital. Additionally, the selected entrepreneurs will receive $5,300 in small business grant funding from Fifth Third’s Empowering Black Futures Initiative.

Empowering Black Futures Credit Readiness Program Grant Recipients:

Prince Uduka

Conrad Shopping LLC

Grove Park – Atlanta, GA

Leah Hernandez

Young Authors Publishing

Grove Park – Atlanta, GA

Deona Frierson

The Excellent Marriage

Historic West End – Charlotte, NC

Jorieka Downey

Grits CLT LLC

Historic West End – Charlotte, NC

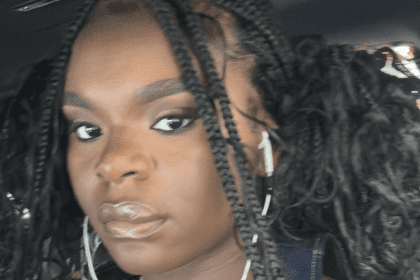

Shika Myrickes

Shika & Company Extensions

South Chicago – Chicago, IL

Doreetha Wheatley

South Chicago Hub

South Chicago – Chicago, IL

Arielle Nelson

Saturday Morning Vibes Cereal Bar

Avondale – Cincinnati, OH

Arthur Norman Jr.

Dipped Custom Prints

Near East Side – Columbus, OH

Antoinette Parks

Chef Butcher’s Creole Kitchen LLC

Near East Side – Columbus, OH

Raeshawn Bumphers

Pink Poodle Dress Lounge

Gratiot -7 Mile – Detroit, MI

Jameela Simpson

Crumbs Cookie Station

Gratiot -7 Mile – Detroit, MI

Brandon Wright

Wright Way Wrestling

Arlington Woods – Indianapolis, IN

Holly Robinson

Elite Cleaning Professionals LLC

Arlington Woods – Indianapolis, IN

Tiffany Johnson

Kipani’s Kloset

Russell – Louisville, KY

Jamila Maddox

Cincinnati Healing Arts LLC

Avondale – Cincinnati, OH

Martina Thompson

Where Futures Begin

Buckeye – Cleveland, OH

Jennifer Sherman

BeIDT Health

Buckeye – Cleveland, OH

Benea Durrett

Unique Essentials

Russell – Louisville, KY

Kimberly Blackmon

Glowmour Beauty Medispa

East Tampa – Tampa, FL

Natasha Goodley

White & Black Consulting LLC

East Tampa – Tampa, FL

“Business ownership is a key driver of wealth in communities and through generations. I could not think of a better way to advance the broader mission of racial equity than to support wealth creation in communities that have historically experienced wealth extraction,” says Connie Evans, President and CEO of AEO. “By positioning Black-owned businesses to obtain capital and grow, we are empowering not just individual entrepreneurs, but entire communities to seize control of their own economic futures.”

“We are proud to provide capital readiness grants and technical assistance to these minority-owned small businesses to help them grow and thrive,” said Kala Gibson, executive vice president and chief corporate responsibility officer for Fifth Third Bank. “We know that small businesses are the heart of communities, and these impact grants will provide tangible support to help strengthen key areas of their businesses and better prepare them for additional capital.”

The program is part of Fifth Third’s $2.8 billion Accelerating Racial Equity, Equality and Inclusion Initiative providing $2.2 billion in lending, $500 million in investments, $60 million in financial accessibility and $40 million in philanthropy which encompasses the Empowering Black Futures Neighborhood Program. The initiative is focused on four strategic pillars to create more equitable outcomes for its customers and communities through strategic investments, access to capital, financial inclusion and education, and social justice and advocacy.

The Empowering Black Futures Capital Readiness Program runs from January through August 2023.