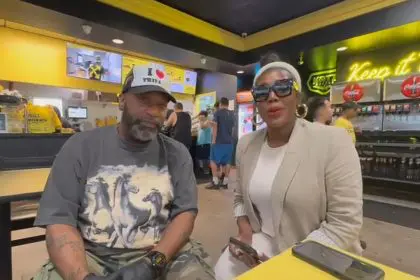

As businesses begin to scale and grow, trying to balance and allocate finances may be overwhelming. Paris Williams and her husband, James Williams, are co-founders of the consulting group Next Level Financial, which helps businesses scale and and take the necessary steps to reach their goals.

Paris spoke with rolling out about Next Level Financial, how the business started, and why people are interested in having a CFO for their business.

What can Next Level Financial do for people with businesses?

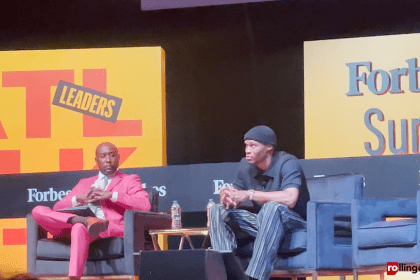

We work mostly with service-based companies, and typically, those companies are in the million-plus range, but my husband James is often on a lot of panels. We will start monthly webinars to give folks just ideas and help as they’re growing their businesses. For example, coming up on June 4, we will be doing a webinar about your pricing model. That’s something that’s really important for people who are figuring out the best pricing for their business, and they want to do something that’s profitable. Sometimes, you have multiple different services that you’re offering, but you want to figure out the ones that are going to make you the most profit. We have some tools that we can provide for people to use on their own if they’re not ready to bring on a CFO that they can use to figure out what’s their most profitable service.

What are the benefits of having a CFO?

Technically, I’m not a CFO; I run the company. My husband, James, is the CFO right now… I would say that our clients really enjoy that they don’t have to do every single thing in a business. If you’re a solopreneur, you are the assistant, you reply to your emails, you are building out your model, you are making the updates, you are networking, and you are doing all the things, including the finances, which is fine when you start, but hopefully you’re building up a team as you begin to scale.

I think the leaders that we work with, I know they would say they love having somebody who enjoys doing the financial part, and two, who’s just consistently helping them to be proactive and not reactive, because a lot of people are just like, “Well, I looked at my account, and it looks good, so we’re going to hire somebody.” If you have $200,000 in your bank account, and that’s your only indication that you can make a big decision, that’s actually not really great. That might work for you in the beginning, but as your business grows, you want to be proactive. They enjoy that we’re always keeping an eye on their business numbers.