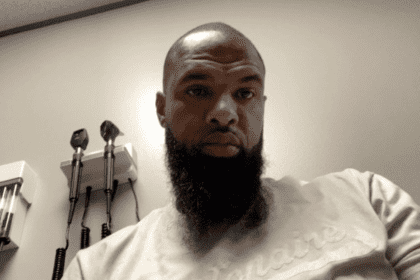

Ian Dunlap, is the founder of Hyper Acceleration, business and finance consulting agency in Houston. Dunlap is a former marketing executive whose past clients include Chevron, Eastern Bank Limited, Reebok, and a fund manager that specializes in a new type of investing. Dunlap spoke with rolling out to share some financial advice during the pandemic.

What are the first things you should do financially when they get their stimulus check?

I want you to know how much of that money you’re going to put to the side. If you’re getting $1,200 or $2,400, Walmart, Apple, Fashion Nova and airlines, are going to try to find ways to take that money out of your pocket. All of a sudden Walmart and Best Buy have amazing deals on TVs. Last week, they had no deals. You have to realize corporations are castles, and their job is to take money out of our pocket to put it into their castle for their family. So before you get your money, decide how much you’re going to save. If you’re behind on your bills, get caught up on those first. After that, I want you to decide how much you are going to save or invest into the market.

How important is budgeting right now?

If you have not started before, you must start now. To be very honest, this isn’t the last crisis you will face, especially if you’re Black. The 90s were tough. 2000-2001 was tough. 2007-2008 was tough. We’re now in 2020 and 2025 will be tough.

For all my brothers and sisters out there, please start putting your money away and start with one goal. Have enough money first to take care of one month’s worth of expenses. Then you want to get to six months worth of expenses and then after that, you want to try and get to 60 months worth of cash reserves. It seems like an impossible goal, but here’s why. Any of us who have ever been laid off, know, if you only have three months worth of savings, it goes like that. For those of us that are Black, our cousins, auntie, Grandma, Nana, they’re going to need help too. And maybe your car broke down. When life hits, it hits hard at one time, so make sure you have enough money put away.

What should businesses know about these loans that are being offered now?

I am anti-debt, personal and business. And it’s a very controversial statement. When I had a lot of loans, I was stressed. If you need a loan, of course, take it, but you need to make a plan on how to pay it back in 24 months, so that you aren’t indebted to a company. The government is not giving you these loans because they love you so much, otherwise it would be a grant. You have to pay these loans back, so be very careful. Go through your paperwork. There are also going to be banks that are going to offer you loans that are guaranteed approval with a high-interest rate. Please stay away from those.