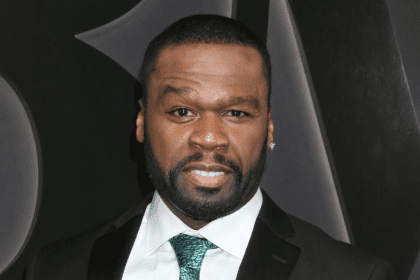

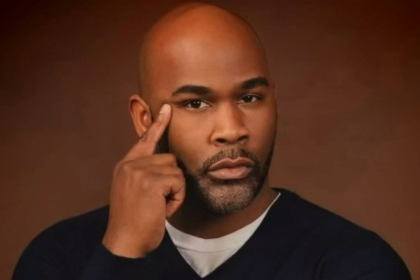

[Editor’s note: The following op-ed was jointly penned by the Rev. Frederick D. Haynes III, President and CEO of the Rainbow PUSH Coalition, and its President Emeritus and Founder, Rev. Jesse L. Jackson Sr.]

Today, we stand at the precipice of a changing tide on Main Street and Wall Street. Diversity, equity, and inclusion initiatives are being dismantled throughout various organizations and industries, essentially undoing decades of progress. Our mission at Rainbow PUSH has always been to serve as a bulwark against such malicious objectives, and we intend to stand firm in this instance. The finance community must know that we remain vigilant, and our work has not been in vain.

For decades, we have challenged and worked with Wall Street to help advance its mission of improving diversity in the financial sector. Advancement proved slow but measurably steady. It is now incumbent upon us to ensure that Wall Street does not join the purge and move away from many of the initiatives designed to fortify inclusion. In part, we recognize this is being done as a preemptive move to help limit the possibility of litigation down the road from entities with a questionable intent who erroneously claim that measures used to provide people of color and diverse talent with opportunities are somehow discriminatory against whites. It appears that efforts to strengthen African American and diverse participation in the financial sector are too much for some to stomach, at a time when the percentage of African American participation alone is already in the low single digits.

Indeed, it was a pivotal moment when Rainbow PUSH appealed to the humanity of Richard Grasso, former chairman and CEO of the NYSE, to strongly urge him and the board to close the exchange on Dr. Martin Luther King Jr. Day for the first time. We believed then as we do now, that Wall Street must acknowledge the historical accomplishments of African Americans and talented diverse individuals while also working to ensure more substantive DEI inclusion recognition remains front-of-mind during the other 364 days of the year.

When initiatives to improve African American and diverse participation are stymied, it hinders growth. But we must understand that inclusion leads to growth, and when there is growth, everybody wins. Over the next 25 years, the African American population is projected to grow by nearly 70 percent. The middle class in communities of color is also rapidly expanding, and it will need relationships with those in the financial sector who understand their unique perspective when it comes to building and sustaining wealth. Why would any industry withdraw from directly engaging with such a growing cluster of prospective consumers? The alternative is a homogenized ecosystem that inevitably breeds timeworn strategies that impede such growth.

The gutting of DEI initiatives in the financial sector is akin to the gutting of the Voting Rights Act, as well as the stripping away of affirmative action last year by the U.S. Supreme Court. These actions imply that we have reached critical mass relative to an equitable society; that we no longer require guardrails on our journey toward a fairer marketplace. Neither is true. As a result, we are left with no strategies in place to encourage diverse participation. Everyone suffers in that scenario.

In its truest sense, DEI is not a societal construct. Nor is it a compliance issue or charitable ideal developed to pacify a voting bloc. Simply put, it is a business imperative that leads to industry expansion where everyone wins. Additionally, DEI is merely a course-correction to level a playing field where Black CEO representation is only 1.6 percent of Fortune 500 companies. DEI also aims to improve the imbalanced relationship and multibillion-dollar trade deficit Wall Street has with diverse consumers, vendors, and entrepreneurs. Wall Street must look to hire, promote, and retain all qualified people regardless of color, gender, sexuality or disability; it must name more minorities to corporate boards; and allocate more capital to minority companies. Leveraging these strategies will help Wall Street stay on track toward an inclusive environment, despite the recent changes to its DEI plans.

The long-term viability of organizations today hinges on their wholehearted embrace and promotion of diversity. However, for some, the concept of diversity and inclusion is affiliated to background noise—an unwelcome distraction they’d prefer to ignore. Nevertheless, it is this persistent advocacy that has propelled us to the current level of progress. We remain committed to amplifying our voices until full parity is achieved on Main Street and Wall Street.