WASHINGTON, DC – The National Association of Real Estate Brokers (NAREB) aggressively seeks to bolster Black homeownership with initiatives that can connect with the more than 2 million African American mortgage-ready renters who are not yet homeowners and other families and individuals in communities across the country.

NAREB President Dr. Courtney Johnson Rose believes the NAREB Building Black Wealth Tour and other initiatives help overcome historical challenges to Black homeownership, such as discriminatory lending practices and unequal access to wealth-building opportunities. The tour, with stops in more than 100 cities, directly brings valuable information about homeownership and wealth building into communities.

“Our mission is to alert families and individuals, and especially those who can qualify for a mortgage, how important it is to buy a home and be put on a path towards generational wealth,” Dr. Rose said. “Discriminatory housing policies have kept our families for generations from opportunities to build wealth. We want everyone to know the important steps and information that can lead to wealth-building and homeownership.”

Potential Black home buyers need accurate information: 45% of Black consumers do not know how much down payment is required, and with lower average credit scores and available funds, general unfamiliarity with mortgage requirements may disproportionately impact Black consumers, according to Fannie Mae’s 2023 Black Housing Journey. In addition, when Blacks are surveyed, they erroneously blame credit scores for their mortgage denials, but HMDA data clearly show the leading reason for their denials is the debt-to-income ratio.

Freddie Mac tracks the number of “mortgage-ready” renters nationwide, meaning they can meet certain income and credit requirements to qualify for a mortgage. Their researchers determined that as of January 2021, 2 million Blacks ages 45 or younger are near mortgage-ready, while another 3.4 million are potentially mortgage-ready.

Moreover, a Fannie Mae survey found that 89% of all Black renters intend to own a home in the future, and half of all Black consumers are renters.

Zillow researchers determined that the incomes of Black rental families increased faster during the pandemic than those of Whites, but the wage gap is still substantial between Blacks and Whites, and there remains a vast disparity in homeownership rates. In 2022, White households had a 73% homeownership rate, compared to 44% for Black households, and the gap exceeded 30% in more than half of the 50 largest metropolitan areas.

Another issue that NAREB’s Black Wealth Tour hopes to address is the lagging of Black millennials in home buying.

NAREB’s 2022 State of Housing in Black America (SHIBA)report found that Black millennials today purchase homes at lower rates than previous generations of Black millennials and millennials from other racial and ethnic groups. Their study found that as Blacks near age 40, they have a homeownership rate about 10 percentage points lower than that of Black Gen Xers and baby boomers at the same age, and the rate is trending sharply downward. This trend, if it continues, could result in at least 900,000 fewer Black homeowners by 2040 than if younger Black renters achieved homeownership at the same rate as Black baby boomers.

In fact, James H. Carr, the lead co-author of the NARAB SHIBA reports, said their research found the homeownership rate for Black millennials to be half of the rate for White millennials. Furthermore, he said five years ago, their study showed that the Black homeownership rate had fallen so low relative to the past generations that the homeownership rate for Blacks might be lower by 2050 than today unless the trends change significantly.

“NAREB’s multipronged efforts, which include identifying and eliminating institutional barriers to mortgage credit while also informing and educating potential Black households about their homeownership opportunities, is key to comprehensively and effectively achieving success in increasing Black homeownership,” Carr said.

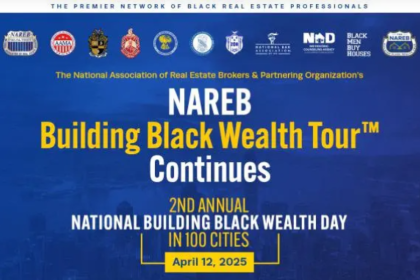

NAREB activated the Building Black Wealth Tour initiative to encourage more families and individuals to purchase homes. Working with the African American Mayors Association and the National Bar Association, the events in more than 100 cities nationwide empower Black communities with steps towards homeownership, property investment, starting a business, and other wealth-building opportunities. Each event includes classes, workshops, and one-on-one counseling. Other partners include Delta Sigma Theta Sorority, Inc., Alpha Phi Alpha Fraternity, Inc., and Phi Beta Sigma Fraternity, Inc.

The tour has held events in Houston, Birmingham, and Charlotte and has upcoming events in Mt. Vernon (4/13/24), Little Rock 6/8/24), New Orleans (8/3/24), and Atlanta (11/9/24), Miramar (3/25), Beverly Hills, MO (6/25) and Los Angeles (8/25).

On April 13, NAREB collaborates with the Church Of God In Christ, Inc. (COGIC) and other partners for National Building Black Wealth Day. In 100 cities, in-person seminars, one-on-one sessions, and panel discussions on homeownership, property investment, starting a business, and other wealth-building opportunities will be held. An internet feed will make virtual sessions and online conversations accessible to a national audience. Go to www. narebblackwealthtour.com to register for the live feed and local events.

These educational activities can help address the hurdles Blacks face on their path to homeownership.

“Systemic issues make the dream of homeownership more difficult to achieve and also contribute to the ongoing wealth gap between African American communities and their counterparts,” Dr. Rose said. To address these disparities, a concerted effort from various sectors of society is crucial. This includes our Building Black Wealth Tour and advocating for policies that aim to dismantle discriminatory practices in the housing market and invest in communities historically underserved by financial institutions. “

Further, Dr. Rose said, “Only through a holistic approach can the dream of homeownership become an attainable reality for all African American mortgage-ready renters, thereby paving the way for economic empowerment and long-lasting change.”

ABOUT THE NATIONAL ASSOCIATION OF REAL ESTATE BROKERS

NAREB was formed in 1947 to secure equal housing opportunities regardless of race, creed, or color. NAREB has advocated for legislation and supported or instigated legal challenges that ensure fair housing, sustainable homeownership, and access to credit for Black Americans. Simultaneously, NAREB advocates for and promotes access to business opportunities for Black real estate professionals in each real estate discipline. From the past to the present, NAREB remains an association that is proud of its history, dedicated to its chosen struggle, and unrelenting in its pursuit of the REALTIST®’s mission/vision embedded goal, “Democracy in Housing.”

NAREB Wants All Americans to Enjoy the American Dream of Homeownership