Former New York Giants teammates Michael Strahan and Eli Manning are vying for a minority ownership stake in their beloved NFL team. This competition not only highlights their enduring connection to the Giants but also underscores the evolving landscape of sports ownership.

The bid for ownership

As of May 5, 2025, reports indicate that Strahan has partnered with billionaire Marc Lasry in a bid for a 10-percent ownership stake in the Giants, which is currently being offered for sale by the Mara and Tisch families. This move comes after the Giants announced in February that they were exploring options for selling a minority, non-controlling stake in the franchise.

Lasry, who previously co-owned the NBA’s Milwaukee Bucks from 2014 to 2023, brings significant financial backing to Strahan’s bid. After selling his share of the Bucks, Lasry raised nearly $450 million to launch Avenue Sports, further solidifying his position in the sports investment arena. His recent ventures also include ownership in a TGL franchise and an investment in the women’s basketball startup Unrivaled.

Eli Manning’s withdrawal and new strategy

Initially, Manning was in discussions to join the ownership group but later withdrew due to conflicts with his other business commitments. This decision has led to a competitive landscape where Manning is now assembling his own bid for minority ownership with his financial partners. The rivalry between these two former teammates adds an exciting layer to the unfolding story.

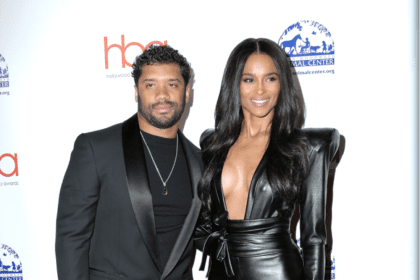

Strahan’s journey from player to media mogul

Strahan, who earned $76.4 million during his 15-season career with the Giants, has successfully transitioned into a media career since retiring in 2007. He is well-known as a co-host on ABC’s “Good Morning America” and serves as an analyst for Fox NFL Sunday. Additionally, Strahan runs his own talent agency, SMAC Entertainment, which recently added NFL star Terrell Owens to its roster.

The Giants’ legacy and financial landscape

The New York Giants, founded in 1925 for a mere $500 by the Mara family, have grown into one of the most valuable franchises in the NFL. The Tisch family became co-owners in 1991 after purchasing a 50-percent stake. The Giants share the $1.6 billion MetLife Stadium with the New York Jets, but their franchise value is bolstered by lucrative sponsorship deals and ticket sales.

As the NFL opens its doors to private equity investments, the Giants are focusing on selling their minority stake to individuals and family offices rather than institutional investors. This strategic decision reflects a desire to maintain a certain level of control and community within the ownership structure.