The reality of a post-racial America appears to be light-years away. Blacks continue to outnumber whites in the prison systems; black students are dropping out of high schools at alarming rates; and the financial gap between black households and white households is at an all-time high.

The reality of a post-racial America appears to be light-years away. Blacks continue to outnumber whites in the prison systems; black students are dropping out of high schools at alarming rates; and the financial gap between black households and white households is at an all-time high.

According to a report conducted by the Economic Policy Institute, 40 percent of black households held a zero or negative net worth during the recession (2007-2009). The study also pointed out the discrepancy of wealth between black and white households. The median net worth of black households was $2,200 and the median wealth for white households was $97,000.

There are several factors that have led to an unequal distribution of wealth in the black community. Due to overt racism during the 20th century, very few blacks were given the opportunity to build and pass along generational wealth. As a result, many blacks are often raised in households that don’t teach the importance of financial literacy.

The study also pointed out that half of all U.S. households owned no stocks at all — either directly or indirectly through mutual or retirement funds.

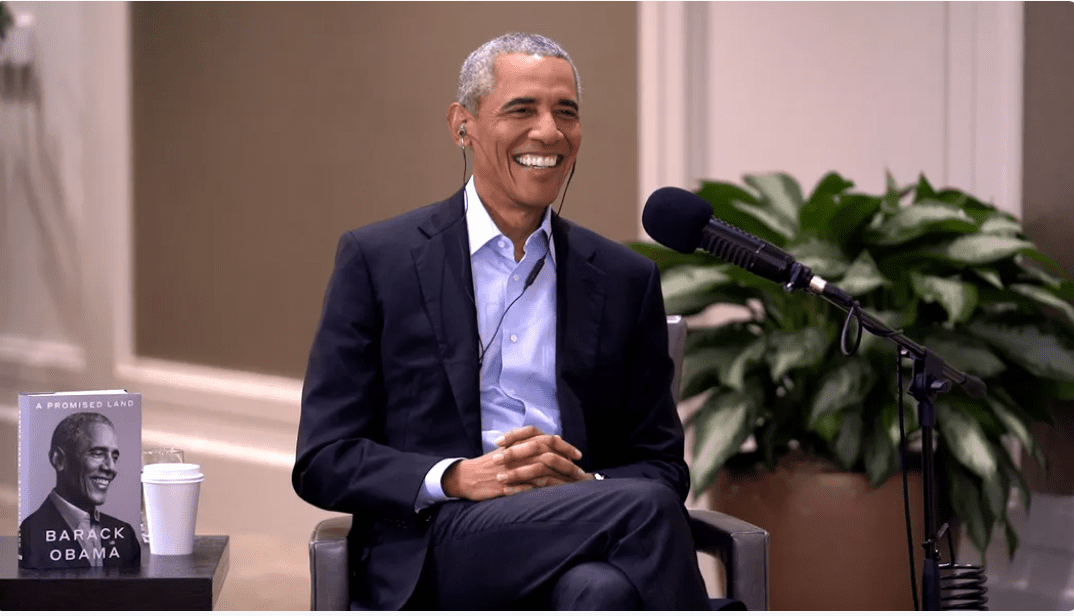

Homes were often the greatest asset for most black families, however; the housing bust caused the value of homes to drop 50 percent. And with the rising number of home foreclosures, the banks now own more stock in homes than citizens. The number of foreclosures will also increase now that House Republicans recently voted to do away with President Obama’s anti-foreclosure program.

Net worth can be calculated by subtracting the sum of all liabilities (mortgages, credit card debt, car loans, outstanding medical bills and student loan debt), from the sum of all assets (real estate, stock holdings, bank account balances, retirement funds and accounts).

–amir shaw