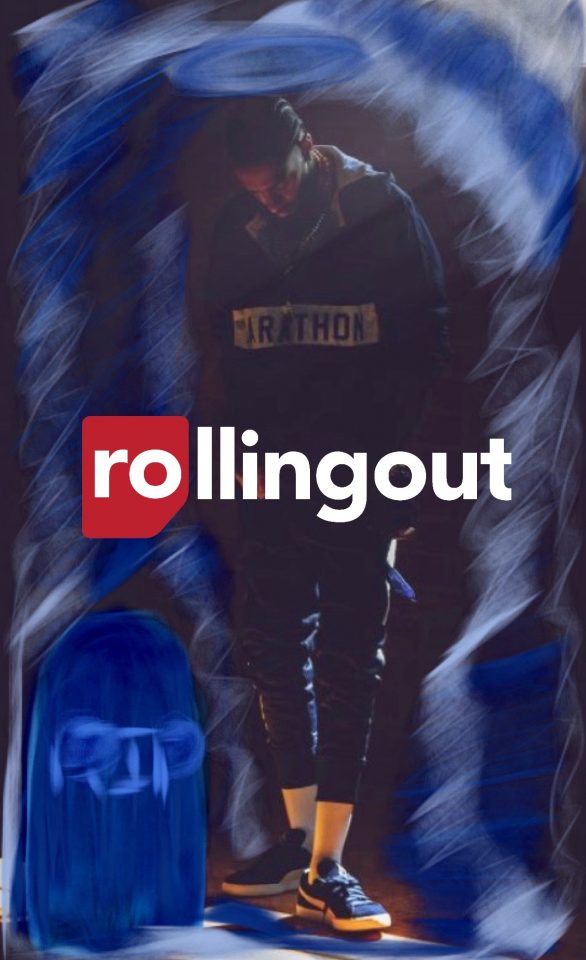

Rapper Nipsey Hussle was gunned down outside his L.A. store on Sunday, March 31. He is survived by his two minor children and longtime girlfriend Lauren London. Assuming Hussle died without an estate plan, all his assets would pass to his children in equal shares since he was not married at the time of his death.

This raises major issues, as minors are prohibited from owning over a certain amount of assets. That amount varies by state, but minors are unable to take possession of the funds until they reach the age of majority, which means a guardian or trustee must be appointed to manage the funds for them until they reach the age of majority. And if there is no estate plan, indicating who that guardian shall be, the courts will make the determination. This also means that longtime girlfriend London would receive nothing from Hussle’s estate (even though he may have wanted her to), as she was not his spouse nor an heir. Here are the reasons you need an estate plan:

- Fulfill property transfer wishes. This is the main goal of estate planning. Your estate is made up of all your property (real, personal and intellectual) minus anything you owe — assets minus liabilities. The heart of estate planning is making the determination as to who gets what and when. You should have clear goals as to who should inherit your property and alternate beneficiaries in case someone predeceases you.

- Minimize transfer costs and taxes. Another main goal of estate planning is to enjoy certain tax benefits and transfer fees. You can limit estate taxes by setting up trusts, making charitable donations, fund qualified personal residence trusts, and by establishing a family limited partnership for your business. All of these tools work to transfer certain assets from your estate thereby limiting your taxable estate.

- Maximize net assets to heirs. The goal is to avoid probate at all costs. Probate lawyers are expensive. Add in court fees and the fact that a typical probate proceeding lasts for at least a year prior to the distribution of the estate, and your assets are being squandered prior to distribution.

- Provide necessary liquidity at death. “Go Fund Me” is not an estate planning tool. There are no guarantees that it will fund anything. The money would need to be readily available to satisfy the immediate needs of the family. This is where life insurance policies, IRA’s, and stocks and bonds come in handy. If all of your property is being transferred by will or intestate succession, no one gets anything until the administration of your estate is finished.

- Fulfill personal wishes surrounding death. Detail all of your preferences concerning the disposition of your body — burial, cremation, and organ donation, so that you can truly rest in peace.

Our condolences to Hussle’s loved ones and prayers up that he had an estate plan, so his family isn’t left to not only mourn his death but to piece together his personal, business and family matters as well.

Nipsey Hussle, gone but not forgotten.

Update: Since the posting of this article, information has come to light that Nipsey Hussle and Lauren London may have in fact been married, which means she would legally share in his estate, with or without an estate plan (which we have no knowledge of whether he had one or not).