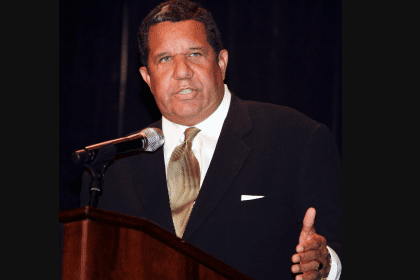

Evan Taylor was first introduced to multicultural marketing through working with the Asian American community. He quickly learned that multicultural communities are far from monolithic and has applied those learnings throughout his career.

Fast forward to today, and Taylor has become MassMutual’s head of African-American marketing, where he advocates for initiatives with a focus on raising the company’s profile in the African American market. Taylor creates internal and external opportunities to ensure that the African American community has access to proper financial tools that can help them secure their futures and protect the ones they love.

He is committed to building MassMutual’s sales force to better reflect the communities that they serve. As a strong advocate for market research, cultural competency and empathy training for financial professionals, Taylor is dedicated to the success of our community both within the organization and within the larger African American community.

What is your role at the company?

I am the head of African American marketing. I work with our financial professionals to provide financial education to address the financial needs of the African American community. Another major component of my work is identifying and helping to recruit African American financial professionals who can serve their communities.

How important is diversity to you? Please explain.

True diversity allows everyone to bring their authentic selves to the table and engage with others as equals. I have been involved with diversity education and engagement since college, but I have been learning about diversity for my entire life. I grew up in a small town in Oklahoma, where I was often the only Brown face in my classroom. I may not have been aware then that what I was exposed to was teaching me the value of diversity, but at an early age, I recognized that not everyone’s story is always shared. Not seeing my family’s history in school made me recognize the gap and realize that diversity has to be worked for. They need to understand the clients’ and potential customers’ needs better. Moreover, diversity and inclusion initiatives in the workplace help people of color and minority groups feel a sense of belonging, which matters so much to our financial professionals; it keeps them engaged.

How do you acknowledge differences in perception, motives and beliefs among consumers with different backgrounds?

For me, it starts with listening. You have to honestly listen to your audience and customer. Then it is all about the research. At MassMutual, we want to understand the needs and concerns of the multicultural consumer so we can educate ourselves and provide excellent service. We work with research firms to conduct focus groups with families to understand what concerns they may have. This allows us to help families meet their financial goals and prepare for the long term. Over the last few years, we have commissioned studies on college saving and planning, financial security and the state of the American family.

How do you approach business challenges?

I generally try to get outside of my own head and understand the perspective of others. This means talking to our financial professionals, customers and centers of influence within the community. This allows me to become inspired, gain empathy, and understand the problem I am trying to solve or address.

Once I have a better understanding of the problem, I dissect it with my co-workers to map out the best approach. Then we can start testing, implementing and measuring ideas and programs.

What are three keys to your success?

Education, mentorship and research.