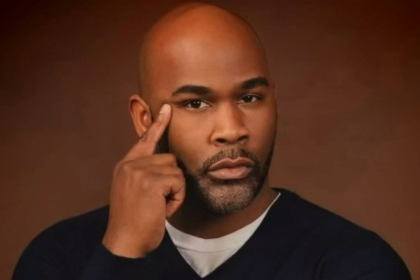

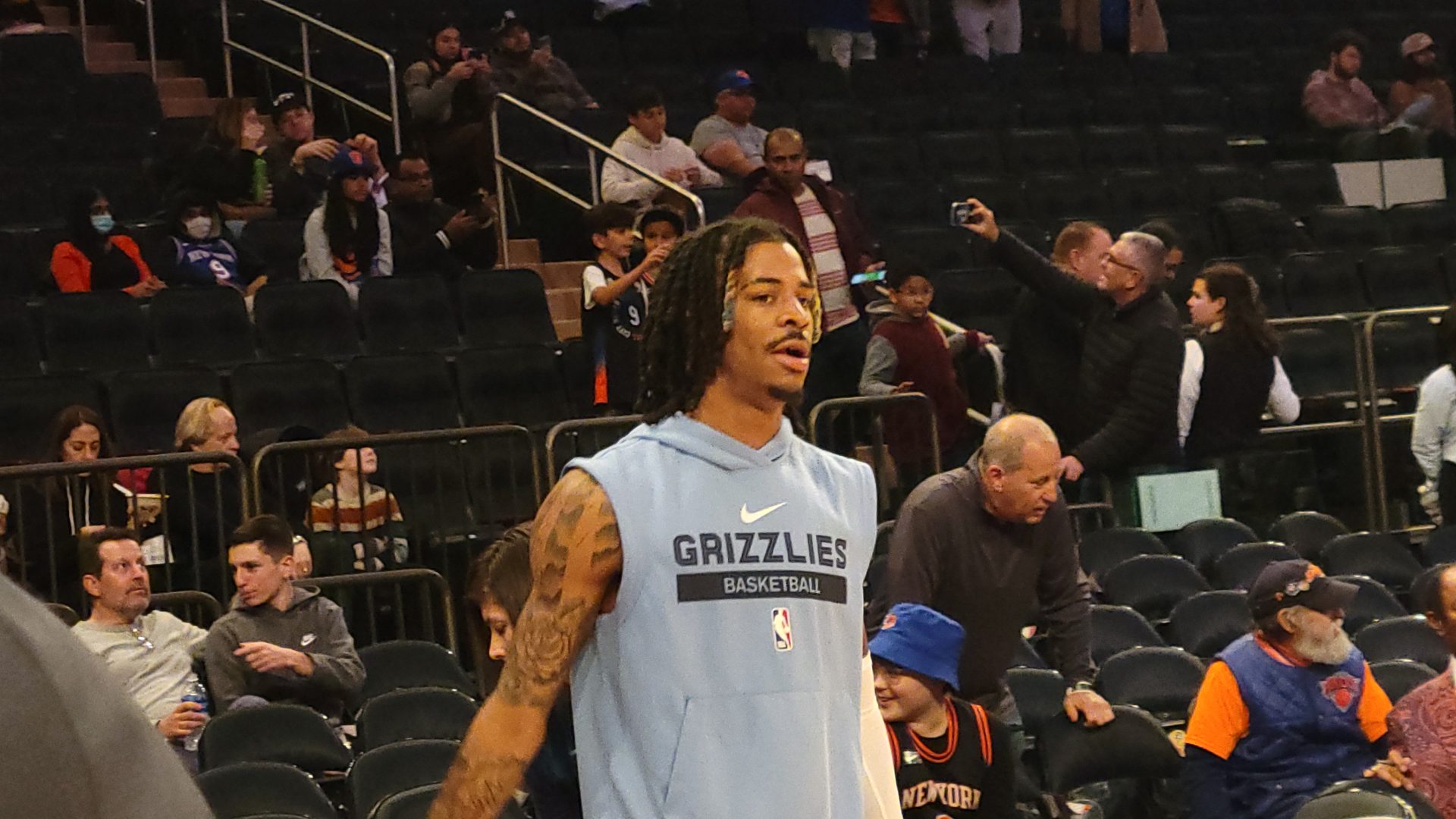

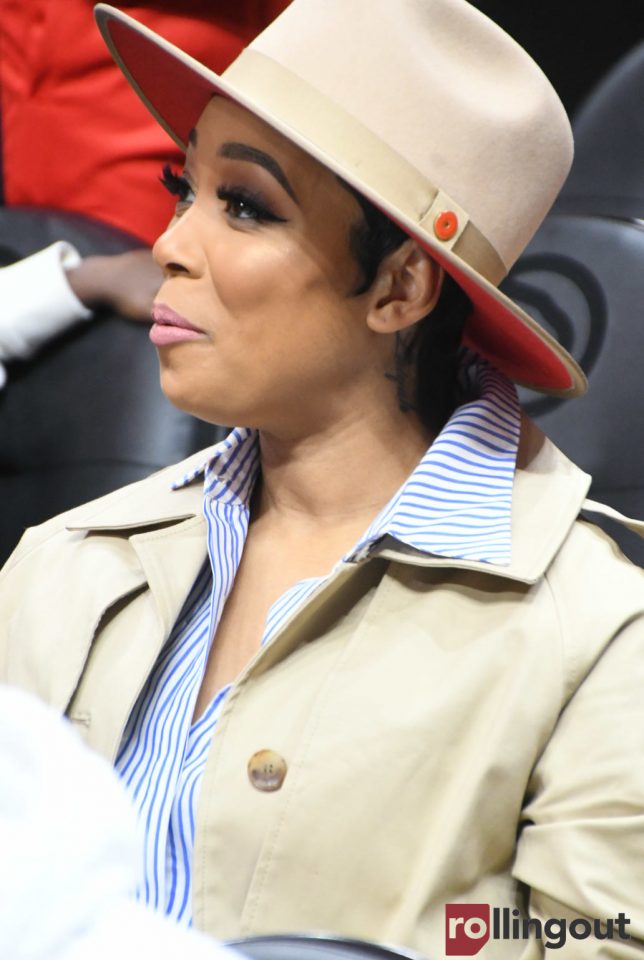

Recording artist Monica filed for a divorce from her NBA baller husband Shannon Brown earlier this month. Instagram photos show her without her wedding ring and with subliminal captions in her posts. The reasons for the split aren’t clear, but one thing that should be is how their assets are going to be divided upon divorce.

Marriage is a joyous time and planning for it should include a plan for what happens just in case things don’t work out. This becomes very important for people of high net worth. Celebrities should employ the following tactics in order to protect their assets prior to marriage:

- Discuss the topic with your significant other. You’re both adults here, and you plan on spending the rest of your lives together. If you’re not comfortable enough to have the conversation, you may want to think twice about marrying each other.

- Know the law. Get familiar with the laws in your state surrounding marriage and marital property, including whether you live in a common-law or community-property state. This will largely determine how assets are split absent an agreement between you and your spouse.

- Get a prenuptial (or postnuptial) agreement. A prenup is a binding contract between the spouses that dictates how assets are to be classified and determines what, if anything, spouses receive at the time of divorce. A prenup is executed before the marriage, and a postnup is executed thereafter.

- Manage your money. Keep all premarital funds in a separate account and maintain separate banking accounts, or open new joint accounts for marital debts and liabilities. Be sure not to commingle funds.

- Name it, claim it. Keep all premarital property in separate names, including the tax bill.

- Keep good records. Maintain diligent records of purchases, transfers and any other transactions.

- Establish a revocable trust. A revocable trust is an agreement that results in the creation of a separate entity that has ownership and control over your assets. Since you are not the owner of the assets, they are not pre-marital or marital property and therefore not subject to division at divorce.

- Know your worth. Determine the value of your business (if an entrepreneur), real estate, retirement accounts or other investments at the time of marriage.

- Get your credit score. Obtain a copy of your credit report at the time of marriage.

- Watch your assets. Be mindful of any appreciation of property during the marriage, and be sure that the increase in value is not attributed to something that was done by you and your spouse.

No one wants to go into a marriage thinking about the exit strategy, but the reality is plenty of marriages end in divorce and finances are one of the leading causes of divorce. You worked too hard to obtain all that you have to lose it in a divorce. Follow these tips to keep all of your assets protected.